Cloud infrastructure services grow 47% in Q2 2017, with AI to fuel next wave of growth

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, 27 July 2017

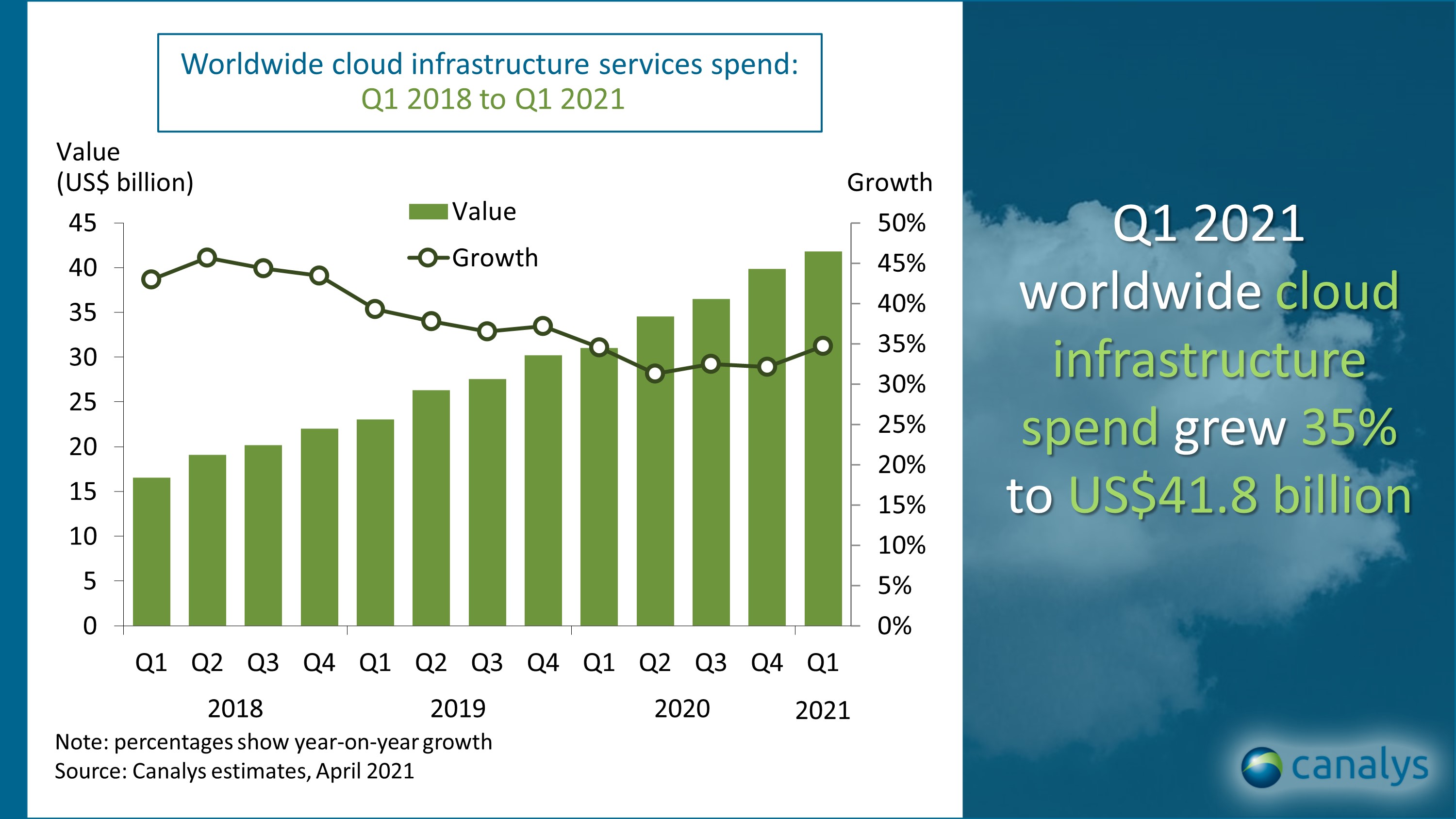

The global cloud infrastructure services market maintained strong momentum in Q2 2017, growing 47% year on year to reach US$14 billion. Amazon Web Services (AWS) remained the dominant cloud services provider, growing 42% on an annual basis and accounting for more than 30% of total spend. But its growth rate was lower than those of its main rivals, Microsoft (97% growth) and Google (92% growth), but higher than fourth-placed IBM (23% growth). Overall, the top four cloud services providers represented 55% of the cloud infrastructure services market, which includes IaaS and PaaS.

Growth was driven by demand for primary cloud infrastructure services, such as on-demand computing and storage, across all customer segments and industries. But future growth will be fueled by customers using the artificial intelligence (AI) platforms cloud service providers are building to develop new applications, processes, services and user experiences.

AWS has an established AI service, focusing on understanding language, speech recognition, visual search, text-to-speech conversion and machine learning technologies. “It continues to strengthen its AI capabilities, with increased accuracy in speech recognition, as well as offering Volta GPU-powered virtual instances in its EC2 to expand its deep-learning capabilities,” said Canalys Research Analyst Daniel Liu. “Microsoft is focusing more on machine reading, which will enable automatic understanding of text. It acquired Maluuba, a deep-learning startup, in January this year as it sees AI as a strategic part of the company’s future growth.”

Meanwhile, Google announced its own dedicated AI chip, called the Cloud TPU, which is the latest version of Google’s custom-built processor that it uses to run its own AI services. Google does not plan to sell the chip directly to others but will offer exclusive access through a dedicated cloud service, which it will launch toward the end of the year. Businesses and developers can build, test and operate software through this cloud service. IBM is placing much emphasis on Watson to drive future growth, with APIs such as conversation, discovery and visual recognition. It is being used for services such as virtual agents in contact centers and security intelligence.

“AI is still in an early stage of development and not delivering significant revenue yet, but it offers tremendous potential, with demand for AI-related workloads expected to fuel cloud services growth,” said Liu. “Leading chipset providers also gained traction, with Nvidia’s datacenter GPU business growing nearly 300%. AMD’s partnerships with Microsoft, Google and Baidu to provide graphics processors for their AI businesses signifies cloud service providers’ growing investment in hyper-scale hardware with AI-focused capabilities. This investment will continue to drive customer spend on cloud services.”

Canalys EMEA: +44 118 984 0520

Matthew Ball: matthew_ball@canalys.com +44 118 984 0535

Claudio Stahnke: claudio_stahnke@canalys.com +44 118 984 0546

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +86 21 2225 2817

Canalys APAC (Singapore): +65 6671 9399

Jordan Mari De Leon: jordan_mari_deleon@canalys.com +65 66 719 397

Canalys Americas: +1 650 681 4488

Alex Smith: alex_smith@canalys.com +1 650 681 4486

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).