Mainland China’s wearable band market hits record high in H1 2025 with 33.9 million units

Wednesday, 10 September 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

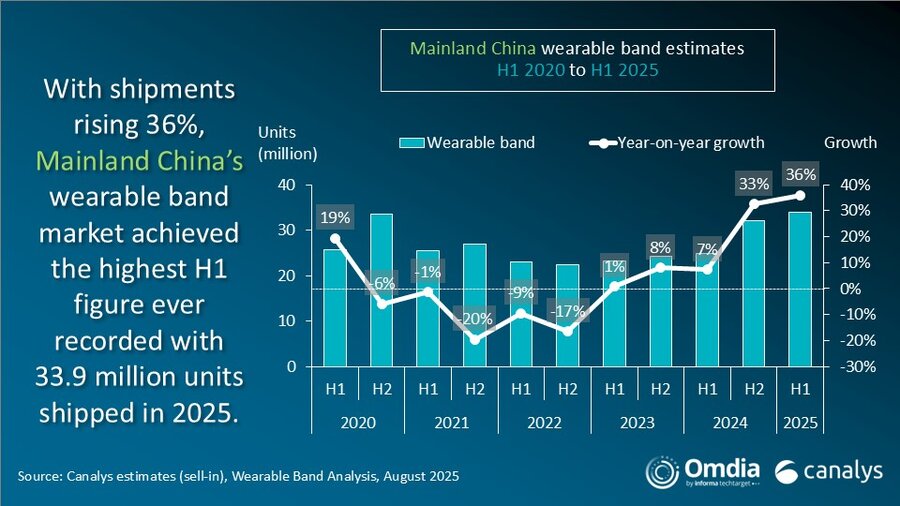

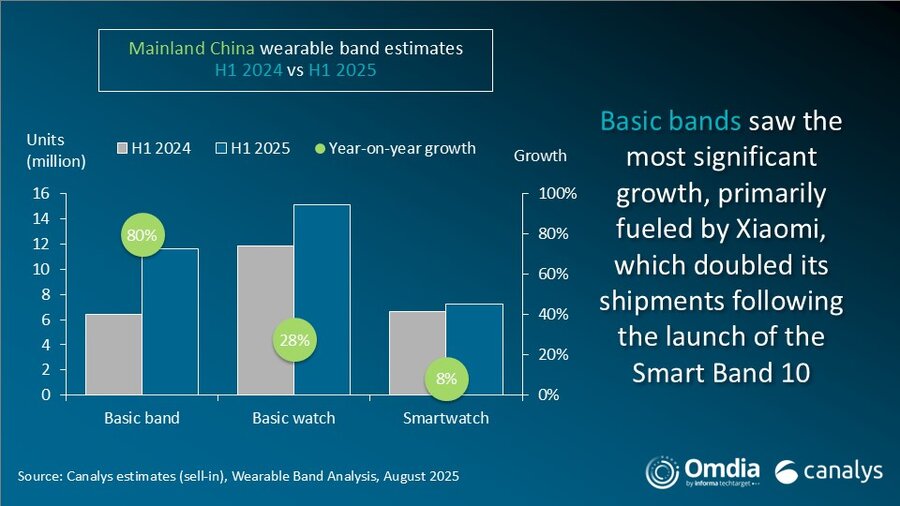

According to Canalys (part of Omdia), shipments of wearable bands in Mainland China reached 33.9 million units in H1 2025. This represents a remarkable growth of 36%, building on a 33% increase in H2 2024. This surge marks the highest number of H1 shipments ever recorded for wearable bands in Mainland China, establishing a new market benchmark. Basic bands saw an impressive 80% growth, making them the fastest-growing category and a major contributor to strong market performance in Mainland China. Huawei led with 12 million units shipped, securing a 36% market share, while Xiaomi followed closely with 11 million units and a 32% market share. Both vendors achieved a notable milestone by surpassing 10 million shipments for the first time in the first half of any year, with Xiaomi’s growth reaching an impressive 101%.

“The national subsidy policies boosted demand for wearable bands by encouraging existing users to upgrade, attracting new users and even rekindling interests in former users,” stated Claire Qin, Research Analyst at Canalys (part of Omdia). “In combination with the major ‘618’ promotions, the subsidy policies have reduced purchasing barriers for price-sensitive consumers and motivated buyers to consider higher-priced basic watches and smartwatches, exemplifying the ‘lipstick effect.’ This aligns with the recent trend of wearable bands featuring enhanced health functions and improved aesthetic designs and materials, even for devices priced between CNY1,599 and CNY2,999 (approximately US$400), driving consumers to trade up and unlock greater value.”

“Vendors with a comprehensive portfolio of wearable devices saw greater market success,” said Cynthia Chen, Research Manager at Canalys (part of Omdia). “Huawei’s Watch GT lineup has secured a strong position in the basic watch market, driven by its emphasis on health management with the integration of premium coaching services. The effective pricing strategy, aided by the subsidy policies that lowered prices to below CNY1,000, further enhances the GT lineup’s market competitiveness. Meanwhile, with the launch of the Smart Band 10, Xiaomi has doubled down on basic bands, enhancing affordability with personalization through feature upgrades and fashion-oriented designs. This strategy has allowed Xiaomi to achieve 101% growth, consolidating its dominance in the budget segment by appealing to younger users eager to own the latest trendy tech.” Apple’s online and offline direct channels participated in the subsidy programs for the first time in June, emphasizing the importance of utilizing the policy to optimize the channel structure and strengthen direct official channels, thereby remaining relevant and maintaining its market positioning in the premium smartwatch market segment.

|

Mainland China wearable bands shipments and growth H1 2025 |

|||||

|

Vendor |

H1 2025 |

H1 2025 |

H1 2024 |

H1 2024 |

Annual |

|

Huawei |

12.1 |

35.7% |

9.4 |

37.7% |

28.9% |

|

Xiaomi |

10.9 |

32.2% |

5.4 |

21.8% |

100.9% |

|

XTC |

2.6 |

7.6% |

2.3 |

9.1% |

14.3% |

|

Apple |

1.9 |

5.7% |

1.7 |

6.7% |

16.6% |

|

vivo |

0.7 |

2.0% |

0.1 |

0.6% |

396% |

|

Others |

5.7 |

16.7% |

6.0 |

24.2% |

-6.0% |

|

Total |

33.9 |

100.0% |

24.9 |

100.0% |

36.0% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia.chen.cn@omdia.com

Claire Qin: claire.qin@omdia.com

Canalys’ Wearable Technology Analysis service provides qualitative and quantitative insights into the wearable band market and addresses the areas where vendors can improve. Our best-in-class service guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and enhance go-to-market strategies to engage in different markets worldwide. The data has detailed splits, tracking a list of 50+ features around connectivity, components, sensors, chipsets and many other different categories. Model-level information is available for 30+ key markets.

Canalys, part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.