Canalys: Huawei takes record 38% share in China as market softens before 5G launch

Shanghai, Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 30 July 2019

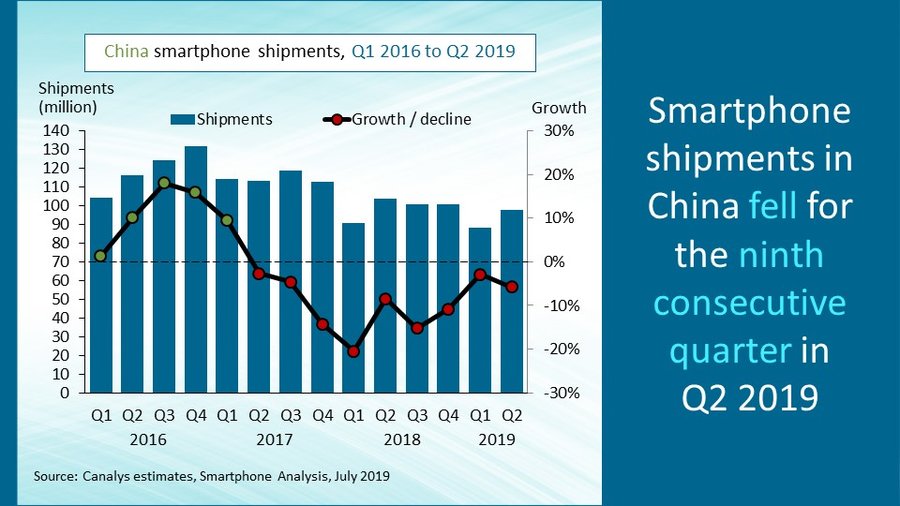

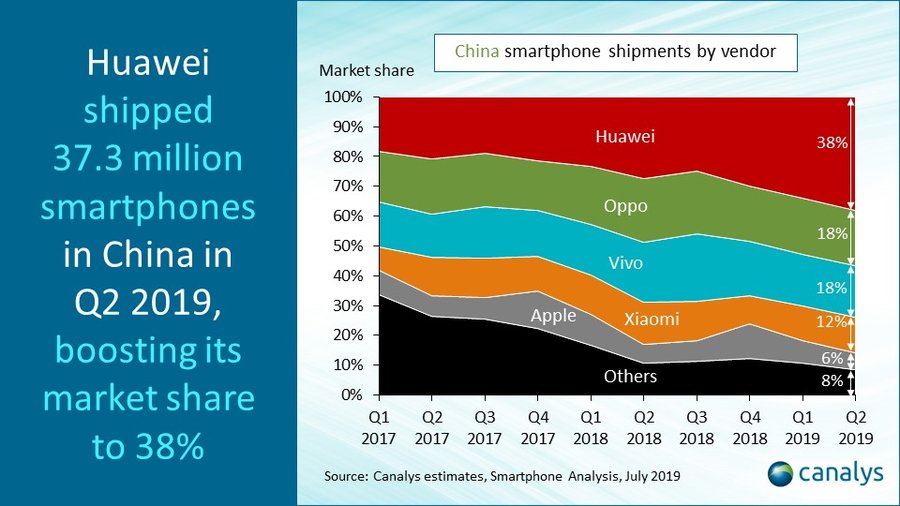

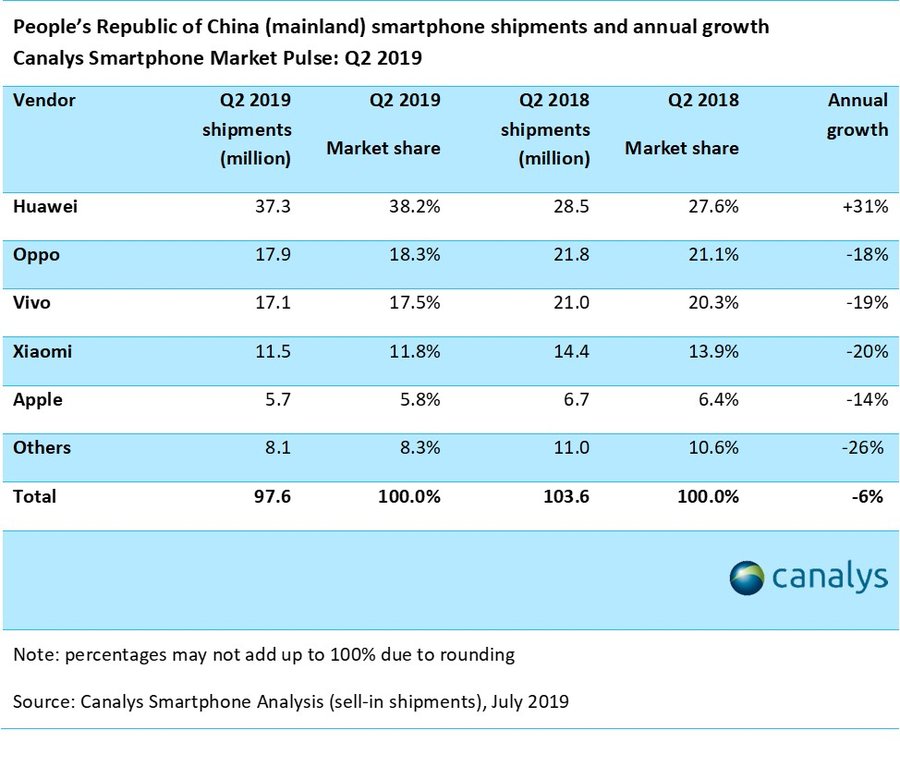

Huawei surged ahead in China in Q2 2019 to achieve the highest market share for any vendor in eight years. It grew phenomenally, up 31% year on year on the back of shipping 37.3 million units. This was despite an overall 6% shipment decline in the world’s largest smartphone market, which fell for the ninth consecutive quarter, to 97.6 million units. Huawei’s major competitors lost ground, with Oppo down 18% after shipping 17.9 million units, Vivo down 19% with 17.1 million units, Xiaomi down 20% with 11.5 million units, and Apple down 14% with 5.7 million units.

Huawei’s global mix shifted back toward China, with 64% of its smartphone shipments in Q2 in its home market. This is the highest ratio since Q2 2013. “Huawei’s addition to the United States Entity List caused uncertainty overseas, but in China it has kept its foot on the accelerator,” said Canalys Analyst Mo Jia. “Its core strategy remains investing in aggressive offline expansion, and luring consumers from rival brands Oppo and Vivo, while unleashing a wave of marketing spend to support new channels and technologies. But the US-China trade war is also creating new opportunities. Huawei’s retail partners are rolling out advertisements to link Huawei with being the patriotic choice, to appeal to a growing demographic of Chinese consumers willing to take political factors into account when making a purchase decision. Huawei itself has also been eager to give more exposure to its founder and CEO, Ren Zhengfei, to enhance its brand appeal to local consumers. At the same time, Huawei’s internal chipset and modem technologies will give it an edge over its competitors as 5G is commercialized by Chinese operators.”

In China, consumers are keeping smartphones for longer and upgrading less frequently. A major factor behind this in the first half of 2019 has been the impending launch of 5G networks and devices. Anticipation around a new network generation is prompting customers to delay the purchase of mid-to-high-end LTE devices, and this has been exacerbated by intensive marketing efforts by vendors in China that are focused on 5G. With the commercial launch of 5G in the second half of 2019, and subsequent improvements in network coverage and quality of service in 2020, consumers will increasingly switch to 5G-capable smartphones. The vendors positioned to succeed in 5G will be those that are the fastest to bring the technology down to prices appropriate for the mass market.

For more information, please contact:

Canalys APAC (China)

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys APAC (India)

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys APAC (Singapore)

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Matthew Xie: matthew_xie@canalys.com +65 8223 4730

Canalys EMEA

Mo Jia: mo_jia@canalys.com +86 158 0076 4291 / +33 7 856 837 66

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Canalys Americas

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com