Canalys: Cloud spend to surpass US$143 billion in 2020, driven by IT channel

Palo Alto, Shanghai, Singapore and Reading (UK) – Tuesday 09 April 2019

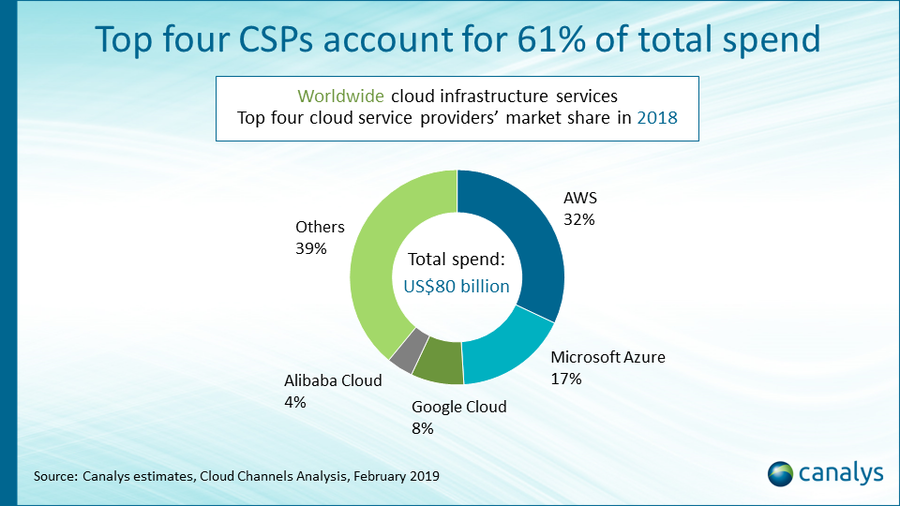

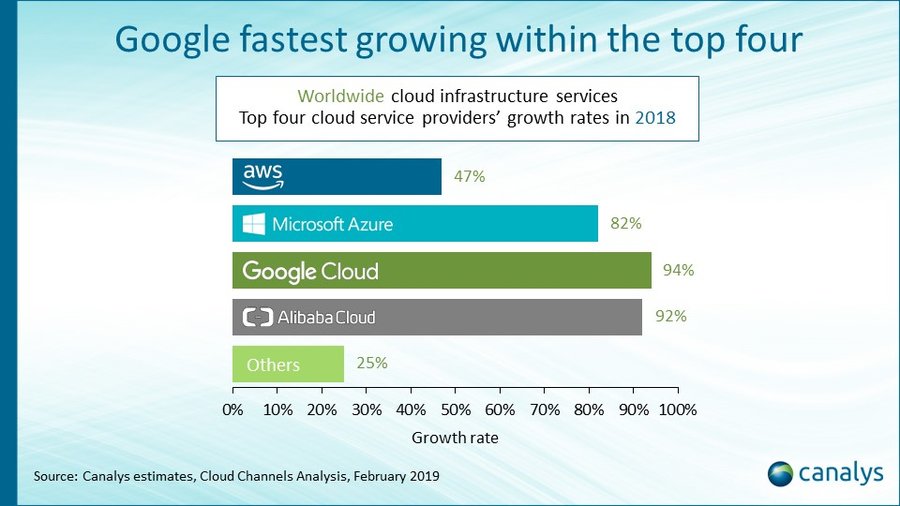

Canalys estimates show that Google Cloud was the fastest-growing cloud infrastructure vendor of the top four last year, up more than 90% year on year, and increasing its share of the total market from 6% in 2017 to 8% in 2018. The top four cloud service providers accounted for 61% of the total market in 2018. Amazon Web Services (AWS) remained the leader on 32%, followed by Microsoft Azure with 17%, Google Cloud in third place with 8% and Alibaba Cloud with 4%. Cloud infrastructure services are in a period of sustained growth, with spending up 46% in 2018 to more than US$80 billion. Expenditure is forecast to surpass US$143 billion in 2020.

Canalys research shows that the importance of the channel is growing for the cloud titans: AWS, Microsoft and Google. This comes as businesses are increasing use of cloud infrastructure services and integrating multiple providers with their existing on-premises IT infrastructure. Canalys estimates 30% of cloud infrastructure services spend, just over US$24 billion, went through the IT channel of distributors, resellers, service providers and systems integrators in 2018. “Amazon Web Services, Microsoft Azure, Google Cloud and Alibaba Cloud are all increasing channel investment to raise their profiles, as competition for enterprise customers increases and workload cloud migration diversifies,” said Alastair Edwards, Chief Analyst at Canalys. “The channel will play a vital role for the cloud service providers, in terms of boosting their customer reach, from both a sales and technical perspective. But each of the cloud service provider titans’ current partner reach, engagement and program maturity differs, with Google Cloud trailing both AWS and Microsoft Azure in all areas. Alibaba Cloud is further back, though it too is investing in the channel as part of its international push.”

Canalys estimates the top three providers represented 65% (US$16 billion) of the channel’s total cloud infrastructure services business in 2018, with Microsoft currently the most important. “Microsoft manages one of the largest channel ecosystems in the technology sector and its Cloud Solution Provider (CSP) program is the most mature among the cloud titans,” said Edwards. “Approximately 74% of revenue from Azure is estimated to come via its partners, which is by far the highest percentage in the sector. In contrast, AWS’ channel business accounts for around 15%, though its reach is growing rapidly, AWS having recruited over 35,000 partners to date, with hundreds a month wanting to join its partner program.”

Canalys estimates that Google Cloud’s channel business accounts for just over 25% of its US$7 billion cloud infrastructure revenue. “In spite of Google Cloud’s rapid growth, its channel reach is relatively small, though it is trying a differentiated approach by being more focused on specific applications and verticals,” said Canalys Senior Director, Channels, Alex Smith. “An estimated 13,000 partners have joined its partner program, of which just over 100 have achieved the highest-tier Premier Partner status, while less than a third of those have achieved a Specialization Partner designation.”

In a recent Candefero channel survey, 20% of respondents think there is huge potential to working with Google Cloud, while 22% said they will work with other cloud service providers instead. But 44% of partners were intrigued to know more about what partnering with Google would be like. “Google has a consumer culture, while Google Cloud’s new leadership brings experience of working with the largest enterprise customers. But it has not captured the broader channel where AWS and Microsoft are being more proactive,” Smith added.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Alastair Edwards: alastair_edwards@canalys.com +44 7901 915 991

Matthew Ball: matthew_ball@canalys.com +44 7887 950 505

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +86 158 0075 6471

Canalys APAC (Singapore): +65 6671 9399

Sharon Hiu: sharon_hiu@canalys.com +65 9777 9015

Canalys Americas: +1 650 681 4488

Ketaki Borade: ketaki_borade@canalys.com +1 650 387 5389

Alex Smith: alex_smith@canalys.com +1 650 799 4483

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com