A warning for vendors as nearly a quarter of partners say programs not important

Palo Alto, Shanghai, Singapore and Reading (UK) – Monday, September 3 2018

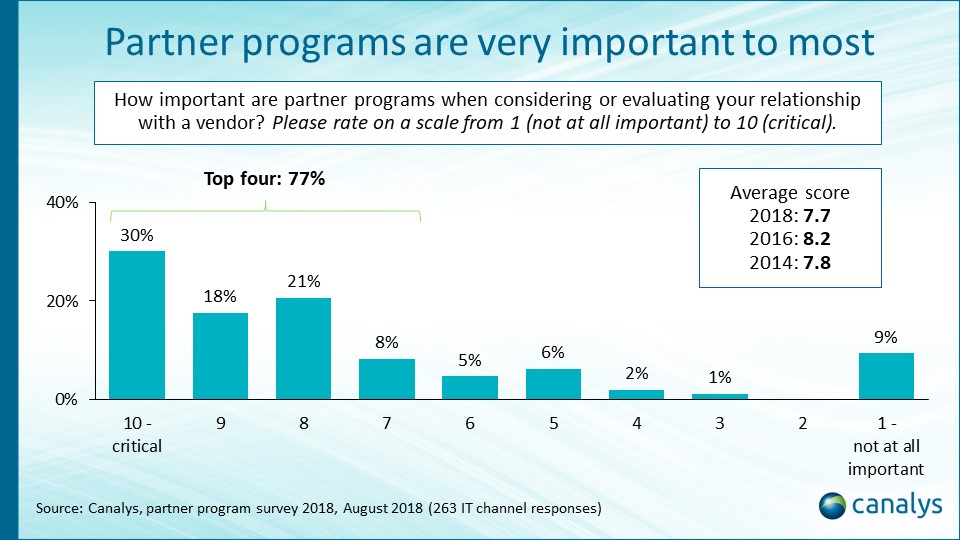

The latest research from analysts at Canalys reveals that the importance of IT vendor programs to channel partners in 2018 has fallen compared with 2016. 77% of those surveyed in August 2018 rated partner programs as important when evaluating vendor relationships. This was down from 94% when the same question was asked in 2016 as part of Canalys’ biannual partner program survey on Candefero, the unique online channel community. 9% of respondents surveyed in 2018 rated partner programs as “not at all important”, while almost a quarter rated them as lacking importance (six or less on the ranking scale).

The results come as a warning to vendors that they must get partners aligned as the market faces disruption from cloud and digital technologies. “Increasingly, the ball is in the channel’s court,” said Alex Smith, Senior Director of Channels Research at Canalys. “Partners have more levers to pull. They can provide more of their own services or make new technology vendor partnerships to fulfill specific opportunities. Meanwhile, vendors often change programs to reflect changes in partner business models and to spur loyalty, but such changes can have the unintended consequence of increasing complexity, leading to frustration.”

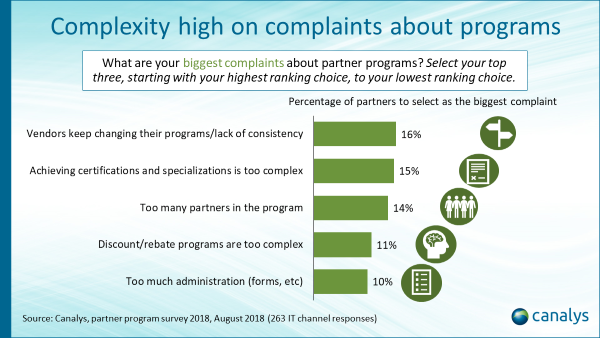

A lack of consistency/changes to programs was the top complaint, with 16% of respondents selecting it among their top issues. Complexity in achieving certifications and specializations was the next highest at 15%.

Singapore-based Canalys Analyst Sharon Hiu said, “This research clearly highlights the difficult balance that vendors need to strike. They must continue developing programs to remain relevant to their partners’ evolving businesses, while also minimizing the level of disruption and frustration that changes often create.”

Canalys believes partner programs will continue to be vital to partners as they are fundamental to how they navigate relationships with vendors. Canalys’ ongoing research with channel partners shows vendors must involve partners more in their program planning and strategy discussions to ensure programs are valuable.

“As partners develop different service models, the most successful vendors will be those that effectively help partners adapt their technical capabilities. The huge challenge is to keep programs simple while our industry embraces complex new technologies,” said Hiu.

“Vendors must take action, such as investing in stronger digital tools, including integrated automation and AI-enabled capabilities, to help reduce partners’ manual administration work. Partner managers must also become more empowered and offer personalized support for individual partner needs. The channel is pressuring vendors to do just this.”

About the partner program survey

The Canalys 2018 partner program survey was conducted in July and August 2018 to capture channel partners’ opinions on what aspects of partner programs, including cloud services, are most important to them and what channel leaders should pay attention to when implementing programs.

Partners were asked to provide feedback via an online questionnaire on Canalys’ Candefero website. The survey captured feedback from a total of 263 channel partners from 51 countries.

About the Partner Program Analysis service

This service is unrivalled in its independent analysis of the leading IT vendors’ program offerings, focusing on issues facing vendors when building and maintaining partner programs. It provides qualitative information designed for senior worldwide channel management within vendors from across the IT spectrum.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Alastair Edwards: alastair_edwards@canalys.com +44 118 984 0523

Robin Ody: robin_ody@canalys.com +44 118 984 0552

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +86 21 2225 2817

Canalys APAC (Singapore): +65 6671 9399

Jordan De Leon: jordan_mari_deleon@canalys.com +65 6671 9397

Sharon Hiu: sharon_hiu@canalys.com +65 6671 9382

Canalys Americas: +1 650 681 4488

Alex Smith: alex_smith@canalys.com +1 650 681 4486

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2018. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com