Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Trump administration’s actions signal commitment to grow federal technology spend in 2025

President Trump’s radical policy shifts, such as the creation of the Department of Governmental Efficiency, enactment of tariffs and the “Stargate” AI infrastructure project, present revenue opportunities for federal channel partners in 2025. With a focus on technology, particularly AI, and increased federal IT spending expected under the Trump administration, partners must adapt to align politically, equip for AI projects and navigate potential trade war impacts to thrive in the evolving federal market landscape.

The creation of the Department of Government Efficiency (DOGE), the enactment of tariffs against China, Canada and Mexico, and the announcement of a US$500 billion AI infrastructure project dubbed “Stargate” all mark radical departures in policy from President Trump’s predecessor. Despite the significant uncertainty surrounding the Trump administration, these listed shifts in policy all represent moderate revenue growth opportunities for federal channel partners in 2025.

With China’s recent announcement of DeepSeek heating up the global AI race, expect Stargate to be only the start of Trump’s efforts to ensure the United States’ role as the dominant AI player. A major difference between the first and second Trump presidency is the influence Silicon Valley has on the President and his cabinet this time around: new allies include tech CEOs Sam Altman, Elon Musk, Mark Zuckerberg and Jeff Bezos. This has resulted in technology modernization, specifically AI, becoming a key area of policy focus for the second Trump administration.

While DOGE is set to enact massive spending cuts across the federal government, technology spend will not be one of the affected areas. In fact, DOGE will increase government technology spending. The executive order establishing DOGE charges program administrator Elon Musk to “commence a Software Modernization Initiative to improve the quality and efficiency of government-wide software, network infrastructure and information technology (IT) systems.” With cloud migration having been completed in Q4 2024, this modernization likely refers to AI. To capture this new funding, vendors and partners will not only have to align themselves politically with the Trump administration but also equip themselves for AI projects.

But any substantial increase in new federal technology spend will require more funding. Former US President Joe Biden set the US civilian IT budget at US$75.1 billion for 2025, just a 0.93% increase from 2024 and the smallest increase in over a decade. This is because the budget grew 12.6% in 2023 and 13% in 2024 to allow for agencies to meet the deadline set by Biden’s Executive Order 14028, which required all agencies to migrate to the cloud and adopt zero-trust architecture by September 2024. With that deadline now passed, Biden set the 2025 budget to rein in government IT spending after two years of rapid growth.

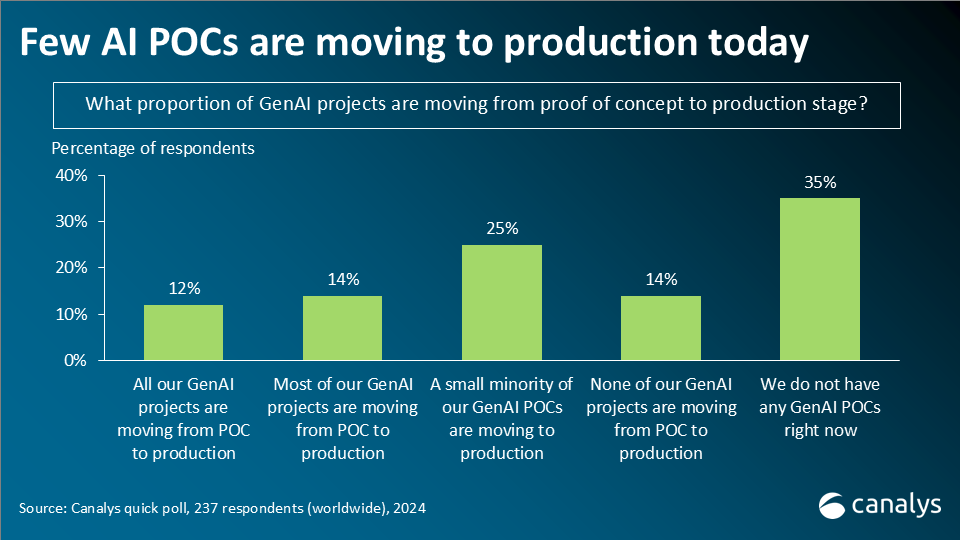

Canalys predicts that the Trump administration will announce new 2025 technology funding for federal agencies in the coming months, well before federal Q4 (July to September) when agencies make most of their purchases. This package will match or exceed the US$32 billion proposed by Congress last summer. Look for this funding package to target AI in particular, as agencies have already migrated to the cloud and upgraded their cybersecurity because of Biden’s executive order. Additionally, agencies have historically lagged far behind the private sector in AI adoption due to regulatory hurdles, many of which President Trump has recently repealed. Channel partners of the largest hyperscalers, in particular, will be tasked with moving AI from proof-of-concept to real-world implementation.

There would be precedent for such a funding package. Last summer, a bipartisan bill proposed US$32 billion in emergency funding for “AI innovation projects” across federal agencies. Two Republicans and two Democrats authored the bill, a rare example of bipartisanship, which served to underline Congress’ serious interest in boosting federal AI funding. Due to the election cycle that bill has since stalled in Congress, leaving just the US$3 billion that was already earmarked for AI in the 2025 US$75.1 billion federal IT budget available to agencies. Significantly, a large portion of that US$3 billion was designated specifically for AI safety initiatives, many of which Trump has now rolled back, leaving very little AI funding to go around.

Additionally, since President Trump’s tariffs will result in increased costs for end customers (federal agencies in this case), this will further justify federal agency requests to President Trump for more technology funding, particularly considering the near stagnant 2025 budget. The tariffs will also encourage agencies to place increasingly large orders this year to future-proof themselves against any future tariffs and price fluctuations. As a result, while most federal business has historically occurred in federal Q4 (July to September), Canalys predicts Q2 and Q3 federal spending will rise to record levels.

So far, the Trump administration’s tariffs have largely served as short-term threats to negotiate deals: in just a few short weeks, tariffs against Canada, Mexico and Colombia have been paused or dropped altogether. It is unclear whether the President’s tariffs will remain short-term negotiation tactics or escalate tensions into a long-term trade war, particularly when it comes to China. This is of particular concern for the largest distributors, since much technology equipment is sourced from China. Distribution is particularly important for the federal market, since the regulatory restrictions and lengthy procedures discourage most vendors from selling directly to the government. Even after distributors, namely Carahsoft, raise their prices on agencies due to the tariffs, frustrated federal customers will find that most vendors will not want to sell to them directly.

Expect the federal IT budget to continue to grow over the rest of President Trump’s term, outside of any short-term spend from DOGE or an AI bill. The federal IT budget has increased every year for the last 13 years, regardless of the political party in control of the White House. Over this period, the budget’s average annual growth has increased, even despite the stagnation in the 2025 budget. During the first Trump presidency, the civilian IT budget grew an average of 6.21% every year, above the 4.99% average under Obama and below the 7.25% average under Biden.

To survive in the fast-changing federal market, partners and vendors alike will need to adapt. For partners, this includes staffing up to be able to handle orders larger than ever before, building AI expertise, improving partnerships with vendors closely aligned with the Trump administration, and expanding business to the state level. Expect vendors to increasingly align themselves with the Trump administration’s policies, acquire or invest in AI partners and ISVs, and build up North American inventory to support the coming distribution crunch.

President Trump’s actions will change the market behavior of partners, vendors and agencies alike, regardless of whether his policies are fully enacted or not. While 2025 is shaping up to be a volatile year for the federal channel, opportunity exists across the market for partners to not just survive but grow.