Global cloud spending grows 21% in Q1 2024 as market leader AWS makes CEO change

Thursday, 16 May 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

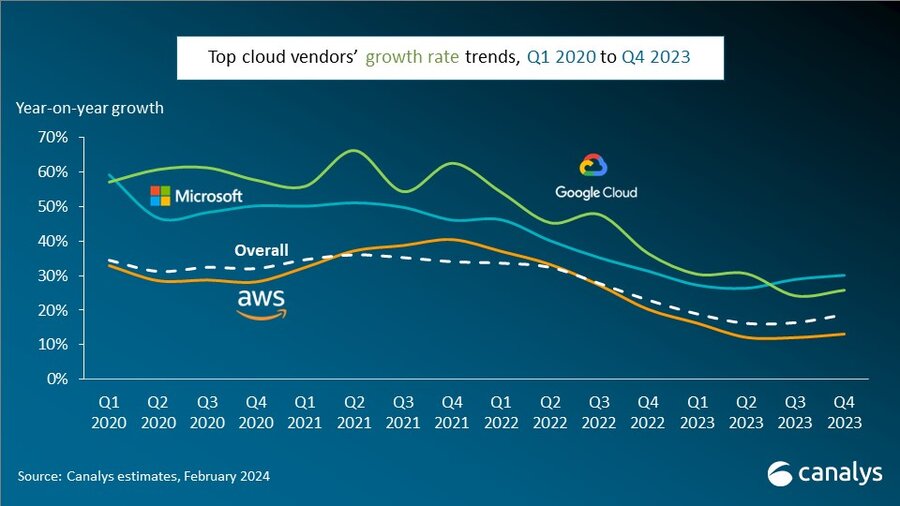

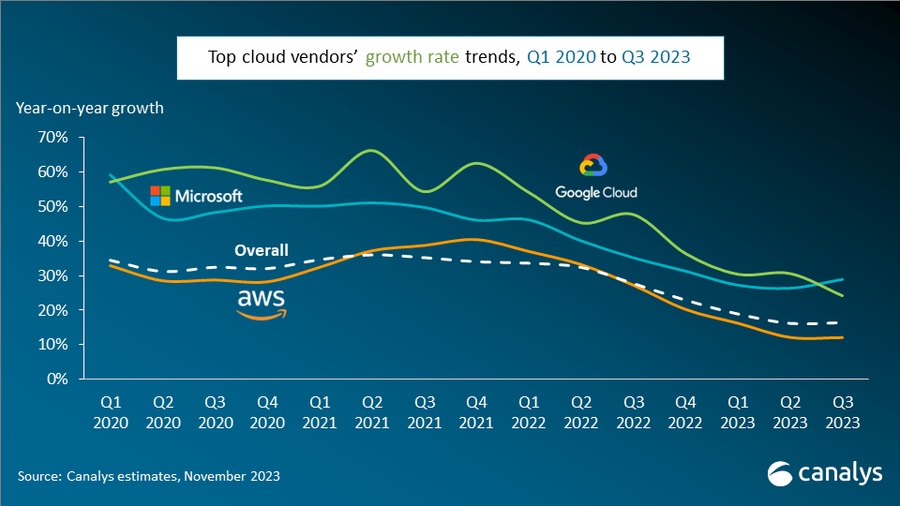

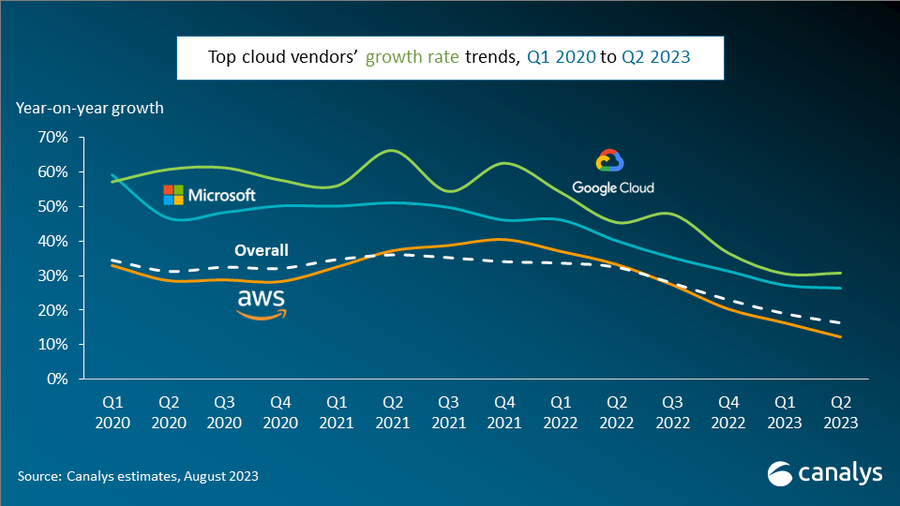

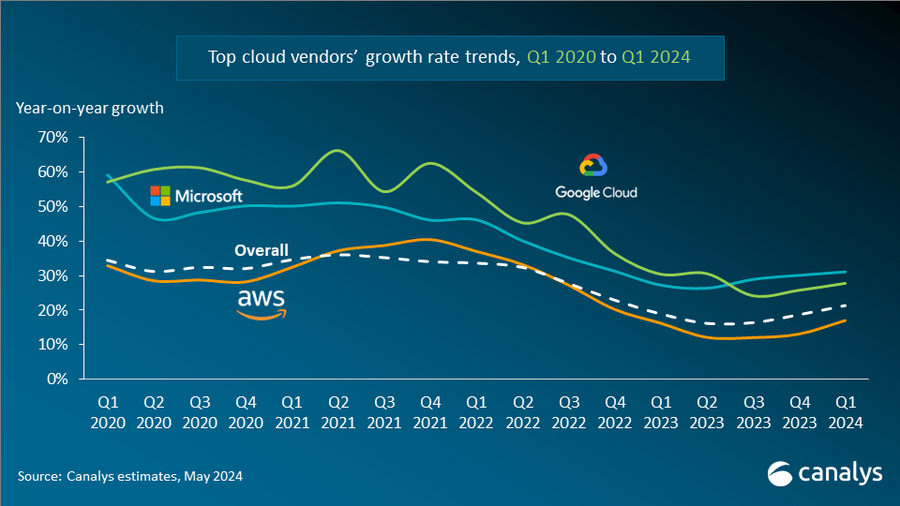

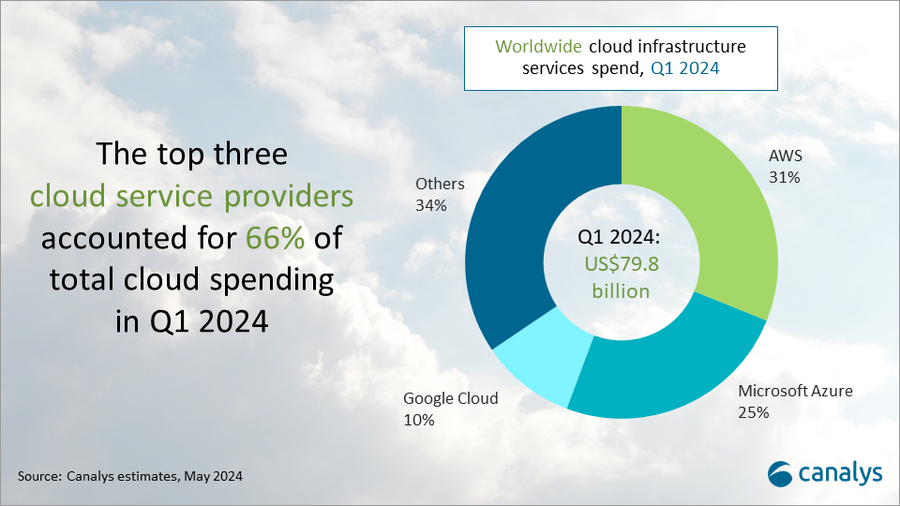

Worldwide cloud infrastructure services expenditure grew by 21% year-on-year in Q1 2024 to reach US$79.8 billion, an increase of US$13.4 billion. The top three cloud providers - AWS, Microsoft Azure and Google Cloud - collectively grew by 24%, accounting for 66% of total spending. All three hyperscalers experienced a growth rate surge, as enterprise cloud spending accelerated. However, Microsoft outpaced both AWS and Google Cloud, with sales rising by an impressive 31% year-on-year, nearly double AWS’s growth rate of 17%, while Google Cloud grew 28% year-on-year. Despite holding the largest market share, AWS faces increasing competition from its fast-growing competitors. In May 2024, the company announced the departure of CEO Adam Selipsky after three years in the role.

AI is an increasingly important demand driver of public cloud investment. The cloud effectively caters to the increased demand for computing and storage in AI applications. Global demand for AI integration with cloud technologies is motivating hyperscalers to integrate AI-enabled features into their cloud offerings and build strong partnerships with companies at the forefront of AI development.

Enterprises are shifting their focus from optimizing cloud budgets toward investing in new initiatives, fueled by a potential AI integration. All three of the top hyperscalers saw an increase in the number of multi-year commitments from enterprise customers, suggesting that many businesses are readying themselves for a long-term increase in cloud consumption. “There is significant variation in the strategies of the top three hyperscalers, reflected in their differing growth rates,” said Yi Zhang, Analyst at Canalys. “Microsoft's end-to-end portfolio is proving to be a strong competitive moat, while Google's strength in AI is giving it a strong tailwind. However, AWS' recent US$4 billion investment in Anthropic for generative AI and its ongoing AI integration in its cloud services underscores a determination to stay ahead of the pack as business priorities shift to AI.”

Fueled by the AI revolution, enterprises are reevaluating their entire technology stack, signaling a significant inflection point for cloud computing. As organizations embrace AI-driven initiatives, there is a potential need to transfer their workloads and data to cloud platforms to avail themselves of essential computing and storage capacities. However, the process of transitioning to the cloud can be intricate and financially burdensome, which potentially hinders the adoption of AI. Addressing these transition costs to enable a seamless migration to cloud services will be key to unlocking the full potential of AI adoption.

“The convergence of AI and cloud represents a transformative juncture, reshaping how businesses approach technology for innovation and growth. Businesses must navigate the complexities of optimizing costs associated with AI infrastructure, including compute resources, storage and data processing, while ensuring that investments in AI technologies yield tangible returns,” said Alex Smith, VP at Canalys. “Looking ahead, cloud service providers as a whole will endeavor to capitalize on this trend by embedding AI in their products and solutions, making AI integration not something novel, but the norm.”

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Alex Smith: alex_smith@canalys.com

Yi Zhang: yi_zhang@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.