Mainland China’s smartphone market records 4% full-year growth in 2024, led by vivo

Thursday, 16 January 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

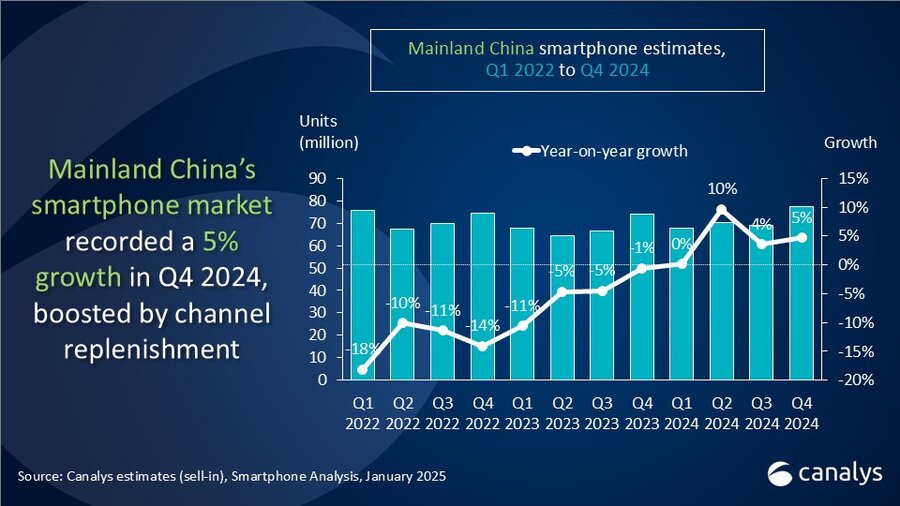

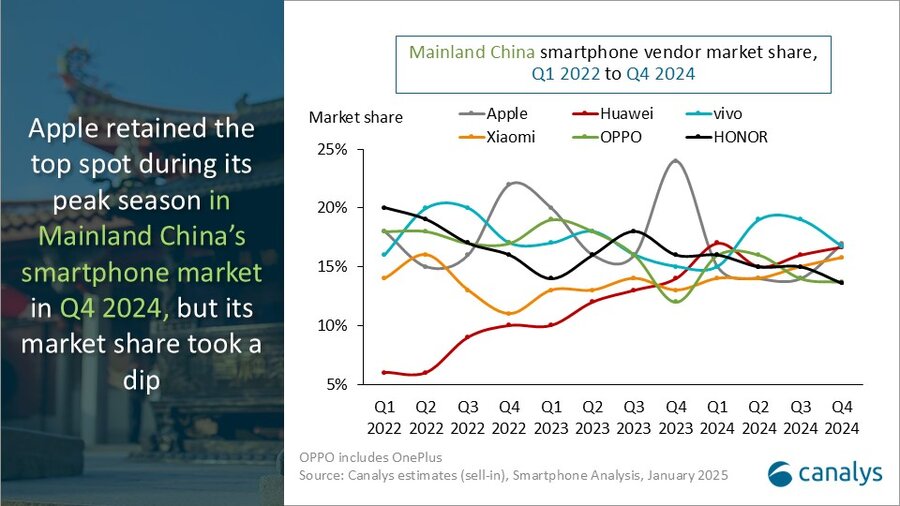

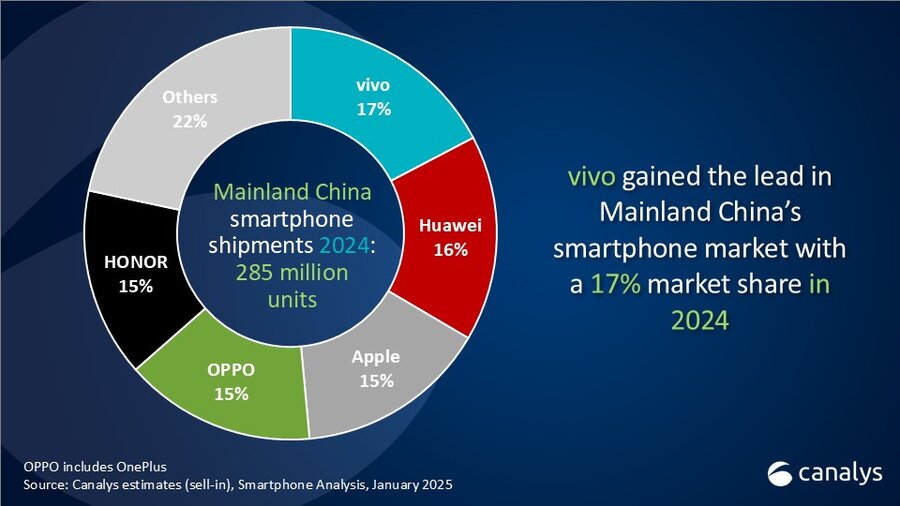

Canalys' latest research reveals that Mainland China's smartphone market shipped 285 million units in 2024, marking a recovery after two years of decline with moderate year-on-year growth of 4%. vivo led the market for the year with a 17% market share, shipping 49.3 million units. Huawei ranked second with 46.0 million units shipped, achieving an impressive year-on-year growth of 37%. Apple, OPPO and HONOR followed in third, fourth, and fifth place respectively, each holding a 15% market share, highlighting the intense competition. In Q4 2024, driven by the high-end peak season, government subsidies and year-end promotions, the Mainland China smartphone market grew by 5% year on year, with shipments reaching 77.4 million units. Apple shipped 13.1 million units in its traditional peak season in the quarter, retaining the top spot. However, due to intensified competition from domestic brands, its shipments dropped by 25% year on year. vivo and Huawei followed closely, both capturing 17% of the market and ranking second and third, respectively. Xiaomi ranked fourth in Q4 2024 with 12.2 million units shipped, achieving the highest annual growth among the top vendors at 29%. OPPO ranked fifth with 10.6 million units shipped, achieving a year-on-year growth of 18% in Q4.

“The Chinese smartphone market demonstrated remarkable vitality in 2024, with steady recovery across all four quarters,” said Toby Zhu, Senior Analyst at Canalys. “Strategic investments and technological innovations by vendors have brought about a resurgence in mass-market demand and prosperity in the high-end segment. In the mass market, brands such as HONOR, OPPO and vivo encouraged consumers to upgrade their devices by offering affordable products with premium designs and robust durability. In the high-end segment, innovations such as GenAI, system development and restructuring—such as Huawei's HarmonyOS NEXT and Xiaomi's HyperOS—as well as in-house chips and foldable form factor breakthroughs, have consistently captivated high-end users and driven them to upgrade their devices. The market growth in 2024 was structurally healthy, achieved through value-added products, technological innovation, market education and recovering demand.”

“Intense competition has led to a constantly shifting landscape, with vendors actively seeking to expand investments in their advantageous field,” said Amber Liu, Research Manager at Canalys. “vivo has shown strong momentum by capitalizing on opportunities across online and offline channels, strengthening partnerships with operators and leveraging marketing efforts and product strategies to solidify its position in entry-level to mid-to-high-end segments. Xiaomi corrected and stabilized shipment cadence in 2024. Its number series has built up user trust and channel confidence over successive generations, while the market success of its EV products and the synergies of its ecosystem offerings, especially home appliances, have provided traction for its smartphone lineup. Xiaomi achieved four consecutive quarters of market share growth in 2024. Apple and its iPhone 16 series maintained the top spot in Q4 but faced growing competitive pressure from domestic flagship devices. In addition to driving sales through seasonal promotions, Apple is enhancing its high-end competitiveness and user retention by improving retail experiences through channel management, offering trade-in programs and expanding coverage of interest-free installment plans.”

“Looking ahead to 2025, Canalys predicts that smartphone shipments in Mainland China will exceed 290 million units,” commented Lucas Zhong, Research Analyst at Canalys. “Mainland China enjoys a uniquely favorable market environment in the global market, supported by an anticipated steady demand recovery, a stable and improving macroeconomic environment and healthy channel operations. Additionally, the nationwide subsidy policy announced by the Chinese government in January, which includes smartphones, has laid the foundation for this year’s market growth. Vendors have already begun preparations for channels and supply. Further upgrades in product experience, such as longer battery life, slimmer and lighter designs, innovative form factors and enhanced AI-powered operating system experiences, will benefit and attract consumers across all price segments.”

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q4 2024 |

|||||

|

Vendor |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

Apple |

13.1 |

17% |

17.5 |

24% |

-25% |

|

vivo |

12.9 |

17% |

11.3 |

15% |

14% |

|

Huawei |

12.9 |

17% |

10.4 |

14% |

24% |

|

Xiaomi |

12.2 |

16% |

9.5 |

13% |

29% |

|

OPPO |

10.6 |

14% |

9.0 |

12% |

18% |

|

Others |

15.6 |

20% |

16.3 |

22% |

-4% |

|

Total |

77.4 |

100% |

73.9 |

100% |

5% |

|

|

|

|

|||

|

Note: OnePlus is included in OPPO shipments. |

|

||||

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: full year 2024 |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

vivo |

49.3 |

17% |

44.5 |

16% |

11% |

|

Huawei |

46.0 |

16% |

33.5 |

12% |

37% |

|

Apple |

42.9 |

15% |

51.8 |

19% |

-17% |

|

OPPO |

42.7 |

15% |

43.9 |

16% |

-3% |

|

HONOR |

42.2 |

15% |

43.6 |

16% |

-3% |

|

Others |

61.6 |

22% |

55.3 |

20% |

12% |

|

Total |

284.6 |

100% |

272.5 |

100% |

4% |

|

|

|

|

|||

|

Note: OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Amber Liu: amber_liu@canalys.com

Toby Zhu: toby_zhu@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, part of Informa TechTarget, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.