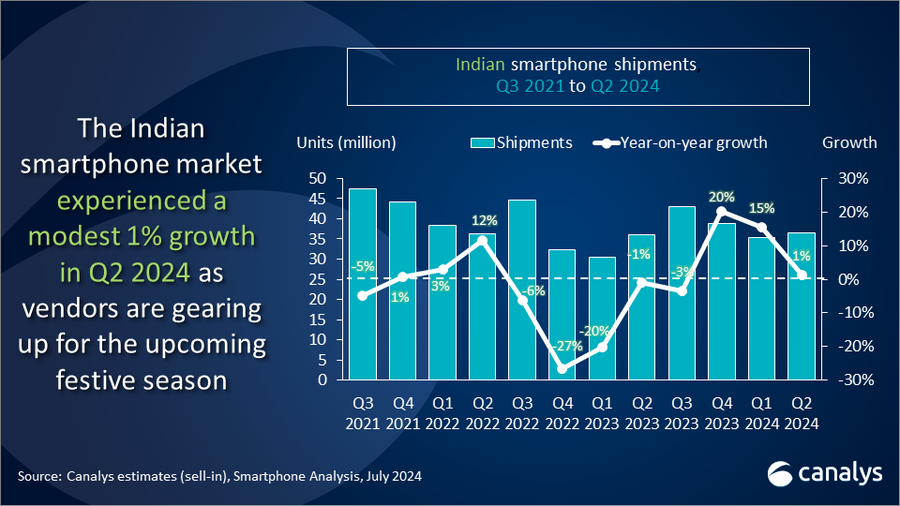

Indian smartphone market grows modest 1% in Q2 2024 as vendors prepare for festive season

Thursday, 18 July 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

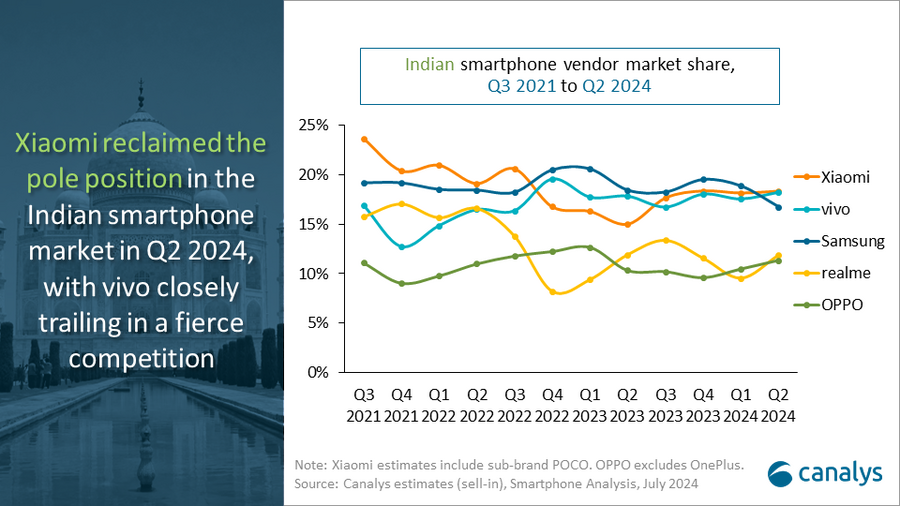

The latest Canalys research reveals that the Indian smartphone market grew only 1% in Q2 2024, amid elections, subdued seasonal demand and extreme weather conditions in some regions, totaling 36.4 million units shipped. Inventory levels remained high with some vendors continuing to launch new devices in higher price segments during the quarter, while others concentrated on reducing existing stocks to optimize inventory ahead of the festival season. Xiaomi reclaimed the top spot after six quarters, capturing an 18% market share with 6.7 million units shipped. vivo closely followed, also shipping 6.7 million units, boosted by affordable 5G and mid-range models. Samsung ranked third with 6.1 million units shipped. realme and OPPO (excluding OnePlus) rounded out the top five with 4.3 million and 4.2 million units shipped, respectively.

“In Q2 2024, top mass-market brands expanded their mid-high-end portfolios and shall use early monsoon sales to clear inventory, making space for new models ahead of the festive season,” said Sanyam Chaurasia, Senior Analyst at Canalys. “Brands such as Xiaomi boosted their mid-to-high-end product lineup, driving volumes for the quarter with the Redmi Note 13 Pro series featuring refreshed color offerings and the newly launched Xiaomi 14 Civi with its camera quality and distinctive leather design. Meanwhile, vivo's success in the mid-range market was driven by the V-series and Y200 Pro, focusing on refined design and camera features, along with increased push through LFR retail stores. realme has also expanded its mid-premium portfolio with the GT 6T and Number series models and plans to clear elevated inventory during the monsoon e-commerce sales.”

“Vendors should focus on business viability over market share, emphasizing strong value propositions for consumers,” said Chaurasia. “The market is grappling with challenges such as fluctuating demand in the mass-market segment, slow migration from feature phones to smartphones and increasing adoption of second-hand smartphones. As a result, brands often resort to creating unnatural demand through festive promotions. Despite consumers purchasing devices at higher prices, fierce competition across different price ranges makes it hard to sustain profit margins as brands compete for market share. Moreover, frequent discounts during festive periods are shaping consumer expectations for price cuts, diluting brand value and squeezing profit margins. Brands must prioritize product innovation, ecosystem development and personalized experiences to ensure consistent year-round shipment upgrades, forging a sustainable business model beyond seasonal demand and deep discounts.”

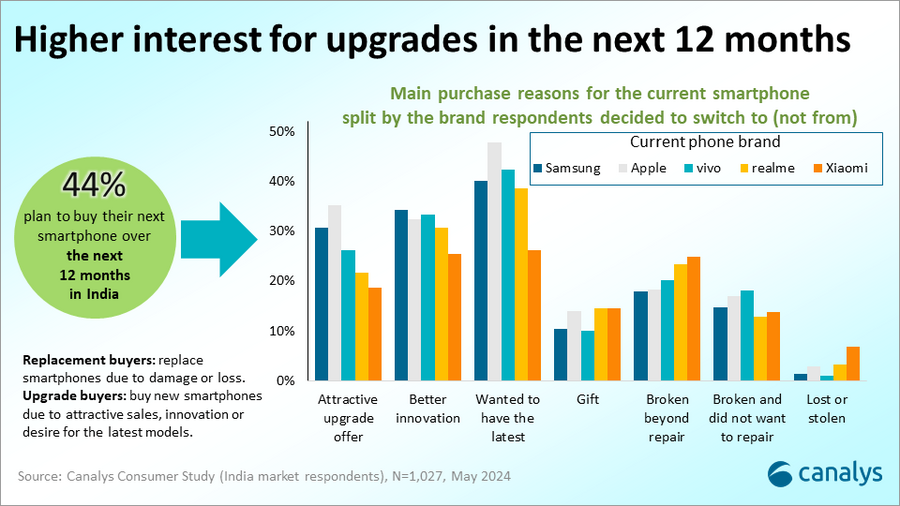

“While 5G device upgrades continue to fuel growth in 2024, vendors will increasingly emphasize ‘brand experience’ across products and channels for long-term gains,” said Chaurasia. “A recent Canalys consumer study revealed that 44% of the consumers expect to purchase a device within the next 12 months, with a significant majority being ‘upgrade buyers’ focused on the latest innovations, including 5G advancements. Canalys anticipates mid-single-digit growth in both the upcoming festive season and overall shipments this year. In the study, young Indian consumers showcased very high openness toward new brands and innovation drivers such as GenAI. In the long term, brands should prioritize enhancing device experiences through GenAI features, ecosystem integration and innovative form factors to capture these consumers’ interests. Notably, delivering such brand experience through retail stores will be crucial for building brand competitiveness.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Xiaomi |

6.7 |

18% |

5.4 |

15% |

24% |

|

vivo |

6.7 |

18% |

6.4 |

18% |

4% |

|

Samsung |

6.1 |

17% |

6.6 |

18% |

-8% |

|

realme |

4.3 |

12% |

4.3 |

12% |

1% |

|

OPPO |

4.2 |

11% |

3.7 |

10% |

11% |

|

Others |

8.4 |

24% |

9.5 |

26% |

-12% |

|

Total |

36.4 |

100% |

36.1 |

100% |

1% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.