The Indian smartphone market shipped 148.6 million units in 2023, witnessing a slight 2% year-on-year decline which fared better than the previously forecasted 6% drop. This stabilization was facilitated by strategic vendor inventory management, the launch of new, more affordable 5G models and an improved consumer environment in the latter half of the year, despite ongoing inflationary pressures. Canalys noted multiple factors that led to this market stabilization:

- Retail channel resurgence: after a slow start with lackluster shipments and unpredictable demand, retail channels bounced back. Brands reassured retailers by clearing old stock and introducing new inventory, improving retail margins, providing consistent discounts, encouraging targeted promotions, hiring additional sales promoters and heightening brand engagement to boost sales.

- Shift to higher price brackets: shipments in India gravitated toward more expensive smartphones, reducing the market share of the sub-US$100 and US$100 to US$199 segments by 2% and 12% respectively. ASPs climbed up due to the market's premiumization trend, but vendors also encountered rising bill of materials (BOM) costs and higher subsidies on retail channels. Consumers will bear the added cost if brands do not compromise on channel incentivization. Brands will look to rationalize the higher price band features in terms of design language, on-device exposure and other integrated smartphone IoT offerings to stay relevant. The trend of rising ASPs is expected to persist in the short term despite some relief from duty reductions on components, as brands grapple with margin pressures, especially in the lower-end market.

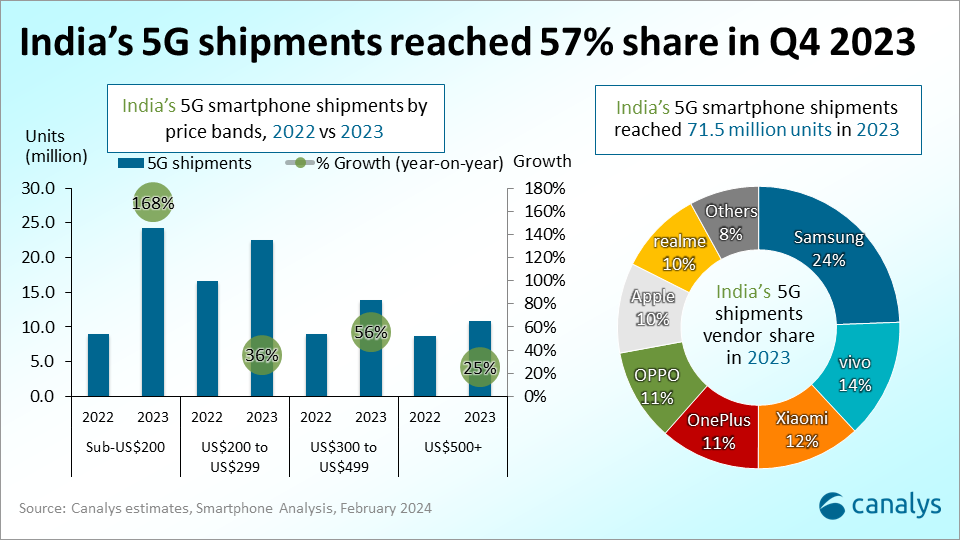

- Affordable 5G drove growth in 2023 and beyond: in 2023, 5G shipments in India surged by 65% year-on-year, fueled by the introduction of budget-friendly 5G-capable models. In Q4 2023, the US$100 to US$199 price segment experienced a remarkable 168% growth, with Xiaomi, Samsung and realme performing well in this segment. Xiaomi's Redmi 12 5G, POCO M6 Pro and the newly launched Redmi 13C drove strong volumes. Xiaomi's POCO has witnessed robust growth of 143% in Q4 2023, mainly driven by the affordable 5G launches, and surpassed OnePlus shipments for the first time in the last two years. Samsung A14 5G in the offline channel and M14 5G in the online channel drove volumes during the festive season while realme's 11x successful launch in Q3 2023 continued to perform well in Q4 2023.

- Apple achieved record shipments: in Q4 2023, Apple achieved its highest shipment levels ever, with a 50% year-over-year growth, shipping nearly 3.0 million iPhones and capturing a 7.3% market share. With the celebration of Diwali in November 2023, Apple was able to drive higher volumes of its latest iPhone 15 series with the overall series contributing close to 2.0 million shipments. The surging demand for Apple products in India was fueled by easy financing options, trade-in programs provided by organized refurbished smartphone vendors and direct banking discounts. As a result, the above-US$500 segment has grown 33% year-on-year in Q4 2023, with Apple capturing a 75% share.

Despite the market stabilization in 2023, there are a few risks that vendors must look to mitigate in 2024:

- Duty cut impact remains limited: in the latest Union Budget, the Indian government slashed import duties on select components from 15% to 10%, aiming to enhance India's manufacturing competitiveness vis-à-vis Vietnam and Mainland China. However, this move will bolster exports rather than drive down device ASPs primarily. At the same time, the reduction is limited to specific components like battery covers and main lenses which are only around 20 to 25% of the BOM, having minimal impact on overall BOM costs.

- Lengthening replacement cycle and slow feature phone transition: vendors are still struggling to stimulate additional market demand beyond the current replacement cycle. The sluggish transition from feature phones to smartphones results from significant headwinds due to macroeconomic challenges. In addition, the growing appeal of the unorganized refurbished market at lower price tiers also affects the sales of new devices.

- 5G in ultra-low-end not driving growth: the ultra-low-end segment, priced below US$120, remains strategically significant due to its large consumer base. However, demand in this segment is susceptible to macroeconomic conditions. Some brands are using financing options and 5G capabilities to boost volumes. Nevertheless, promoting “under Rs.10,000 (US$120) 5G smartphones” is more of a marketing tactic, as the 5G feature offers limited value to this consumer segment, who often have to compromise on other specifications. The slim margins also pose challenges to vendors' profitability in this segment.

Canalys forecasts a 5% growth in the Indian smartphone market for 2024, propelled by 5G adoption and post-pandemic upgrades. Short-term strategies include securing retail margins, optimizing product portfolios and educating retailers about new features to maintain confidence. For sustainable long-term growth, vendors should expand their IoT ecosystems, strengthen retail networks and nurture the local ecosystem.