Huawei: How to secure a foothold in China’s high-end wearables market

31 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

On 24 January 2024, OPPO finalized a global cross-license agreement with Nokia, effectively concluding a two-and-a-half-year patent dispute. This blog discusses OPPO's strategic realignment following its global patent dispute settlement with Nokia, examining the implications for the company's international expansion, partner relations and innovation trajectory.

On 24 January 2024, OPPO finalized a global cross-license agreement with Nokia, effectively concluding a two-and-a-half-year patent dispute. The comprehensive deal spans all mobile communication patents, including essential 5G technology. It will resolve all pending litigation across various jurisdictions, including Germany, France, the Netherlands, India, Indonesia, Mainland China, the UK and four additional countries.

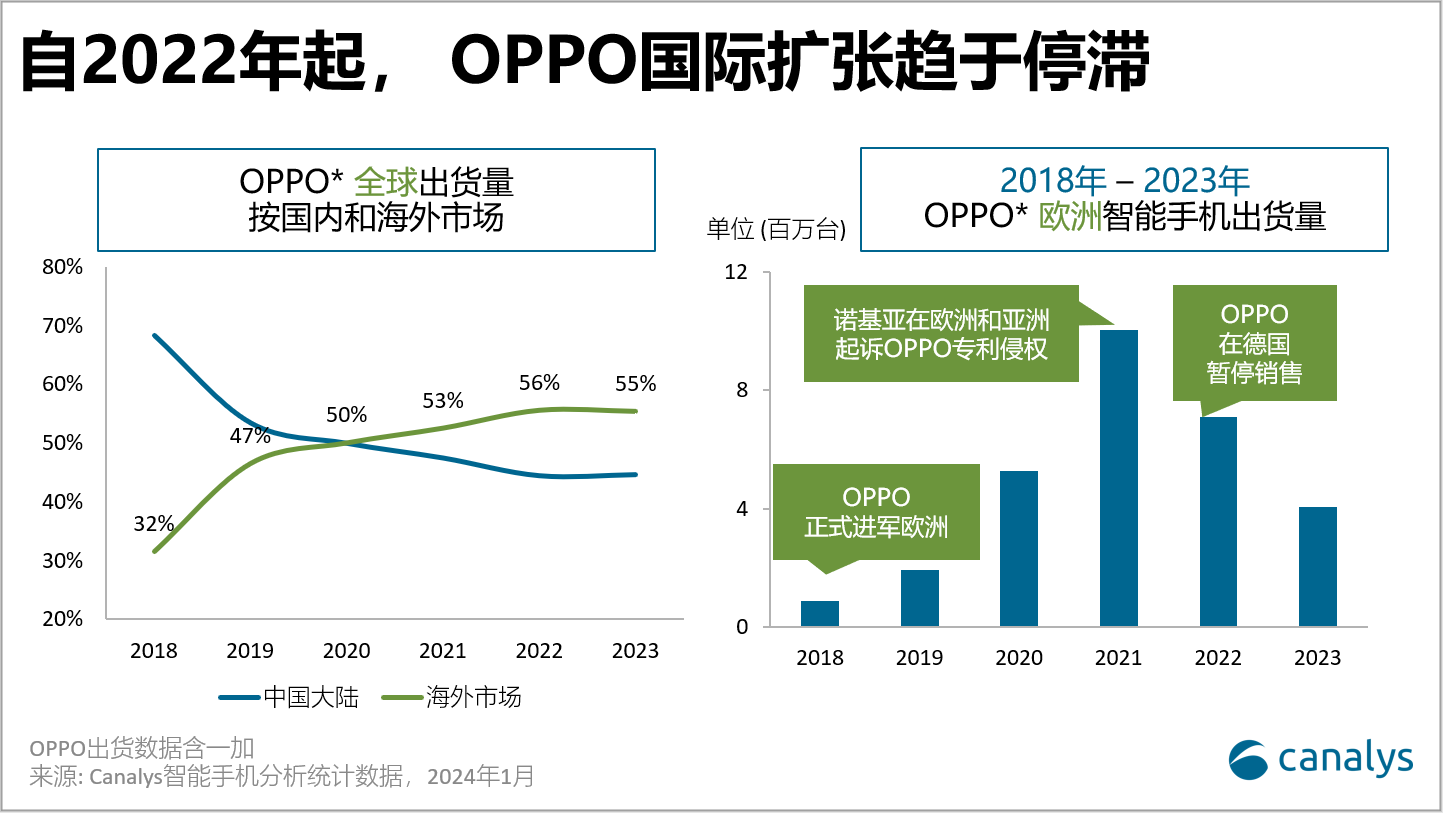

The patent conflict was a notable event in the mobile industry, particularly impacting OPPO's international expansion plans and operations in key existing markets such as China, India and Indonesia. The complexities of managing global operations and the strategic capabilities required to navigate various geographic and business climates have been underscored by this dispute. OPPO's challenges during this period were multifaceted; it had to handle extensive litigation, maintain business partnerships and uphold its brand image in the tumultuous smartphone industry landscape of the past two years.

The settlement has provided substantial relief to OPPO and its affiliates, including OnePlus and Realme. For instance, OnePlus promptly resumed sales in its German online store on the announcement day, indicating an immediate positive turnaround in sales operations following the lifting of legal constraints. The resolution suggests two primary strategic outcomes for OPPO this year:

OPPO's immediate strategy revision is crucial as it emerges from the dispute into a recovering global market. Several opportunities could serve as catalysts for OPPO's short-term growth, despite market challenges and competitive pressures:

Leveraging multi-brand strategy: OPPO can capitalize on its various brands to strengthen its market presence, such as focusing on expanding OnePlus in Europe. The recent OnePlus Open launches in various European markets, which have been well-received, offer a solid foundation for rebuilding local channels and confidence.

Aggressive 5G expansion: OPPO (excluding OnePlus)'s 5G share of its overall shipments outside Greater China has increased modestly from 15% to 31% between 2021 and 2023, in contrast to Samsung's leap from 28% to 61%. OPPO should expedite its 5G integration, especially in European markets where 5G is becoming standard for mid-to-high-end devices.

Global branding campaign: reinforcing OPPO's brand image and innovation commitment is essential. This effort should manifest through launching new products and services, and engaging in thought leadership, particularly in areas where OPPO has invested significantly, such as AI, user experience innovations with foldable devices, and digital health features in wearable technology.

The patent dispute resolution presents OPPO with an opportunity to reassess and recalibrate its global strategy. The effectiveness of OPPO's future actions, particularly in rebuilding partnerships and advancing R&D, will be closely watched by its industry partners and could serve as a benchmark for resilience and adaptability in the dynamic mobile industry.

2024年1月24日,OPPO与诺基亚最终达成了一项全球专利交叉许可协议,结束了为期两年半的专利纠纷。这项全面协议涵盖了所有移动通信专利,包括必要的5G技术。该协议将解决包括德国、法国、荷兰、印度、印度尼西亚、中国大陆、英国和其他四个国家在内的多个司法管辖区的所有未决诉讼。

这两家大厂之间的专利纠纷曾经是移动通讯行业的热点事件,特别是对OPPO国际扩张计划的影响和现有关键市场的运营,如中国、印度和印度尼西亚。这场争端突显了全球业务管理的复杂性,以及在不同地域和商业环境中披荆斩棘,开展业务所需的战略能力。在此期间,OPPO面临多方挑战,过去两年动荡的智能手机行业格局中,OPPO必须处理大量诉讼,必须维持与业务合作关系,还必须维护其品牌形象。

该和解协议帮助OPPO及其关联公司(包括一加和realme)缓解实质性的压力。例如,在公告发布的当天,一加就迅速恢复了其德国电商的销售,标志着在解除法律限制后,销售业务立即出现乐观的转机。该决议预示着OPPO今年的两个主要战略成果:

随着OPPO摆脱争端的阴影,进入复苏的全球市场,OPPO战略调整刻不容缓。尽管市场挑战和竞争压力不容小觑,但仍有一些机会可以成为OPPO在短期内实现增长的催化剂:

运用多品牌战略:OPPO 可以利用旗下的各个品牌来扩大市场影响力,例如重点扩张一加在欧洲的市场。近期一加Open 在欧洲各市场上市,广受好评,为重建当地渠道和消费者信心奠定坚实的基础。

积极推进5G扩张:2021年至2023年间,在OPPO大中华区以外的整体出货量中,OPPO(不含一加)的5G产品份额从15%小幅增长至31%,而三星的5G产品份额则从28%跃升至61%。OPPO应加快5G整合速度,尤其是在欧洲市场,因为那里5G已逐渐成为中高端设备的标准配置。

全球品牌推广活动:强化OPPO的品牌形象并巩固其对创新的承诺至关重要。这种努力应该体现在推出新产品和服务,以及发挥引领行业潮流的领导力,特别是在OPPO投入巨资的领域,如AI、可折叠设备的用户体验创新以及可穿戴技术中的数字健康功能等。

此次专利纠纷的解决给了OPPO一个机会,让公司重新评估和调整其全球战略。在瞬息万变的移动通信行业中,OPPO未来的行动能否成功,尤其是在重建合作伙伴关系和推进研发方面,将受到行业伙伴的密切关注,并有可能成为韧性和适应能力的标杆。