Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

IT spending to accelerate 6% in 2024 and partner-delivered IT to account for 73%

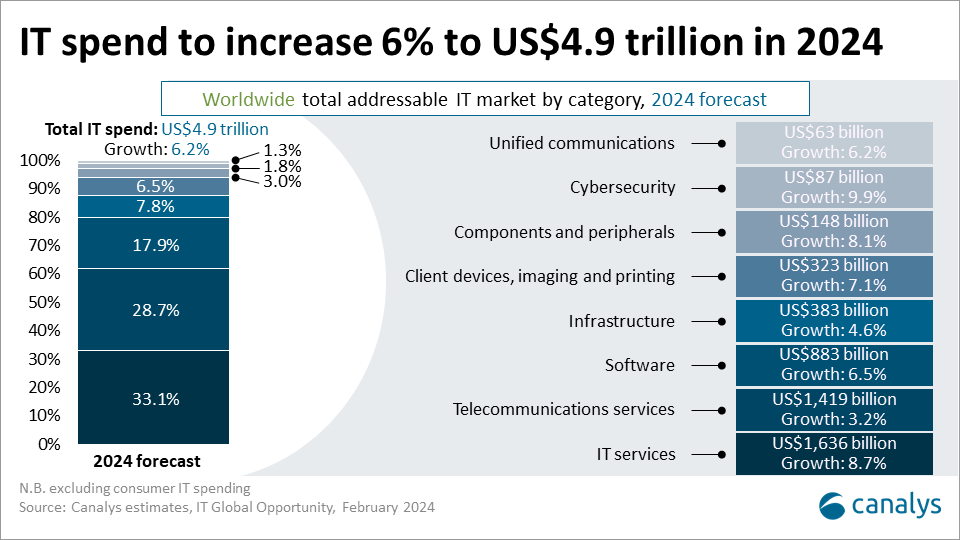

After a period of deceleration, Canalys’ February IT Opportunity update predicts a 6.2% growth in worldwide IT spending in 2024, reaching US$4.94 trillion. This is despite the heightened risk of major disruption from climate change-related extreme weather events, the escalation of conflicts and intensifying geopolitics, energy security, cyber-attacks, and political instability stemming from more than 50 elections covering 45% of the world’s population.

IT spending to accelerate 6% in 2024, partner-delivered IT to account for 73%

2024 will be another exciting year in tech! After a period of deceleration, Canalys’ February IT Opportunity update predicts a 6.2% growth in worldwide IT spending this year, reaching US$4.94 trillion. This is despite the heightened risk of major disruption from climate change-related extreme weather events, the escalation of conflicts and intensifying geopolitics, energy security, cyber-attacks, and political instability stemming from more than 50 elections covering 45% of the world’s population.

Economic headwinds like inflation and potential recession are real, especially in the first quarter of 2024, but organizations continue to recognize the critical role of technology and IT services in transforming and expanding operations, building resilience, and driving employee productivity.

North America leads, Asia Pacific bounces back, EMEA subdued

North America, with its high concentration of tech Titans and startups, government spending initiatives and a workforce skewed toward large enterprises, is forecasted to grow by 6.6% to account for 38.8% of worldwide IT spending. Growth in the Asia Pacific (+7.4%) will rebound, driven by Mainland China and India’s continued expansion. EMEA's (+4.2%) growth will be more subdued due to weak economic trends in key markets, including Germany, which is being impacted by weak exports, skilled labor shortages, high interest rates and uncertainty around energy security.

Stronger than ever: partner-delivered IT will dominate again

Channel partners remain the backbone of the tech industry, accounting for 73.2% of the total IT market in 2024. Across hardware, software and services, Canalys expects them to continue to play a crucial role in scaling vendors' reach and delivering complex technology solutions to customers by providing advisory, designing, building, procurement, adoption and management capabilities. Planning for uncertainty and disruption in 2024 will be paramount for partners, but recognizing how much opportunity there is will be just as important.

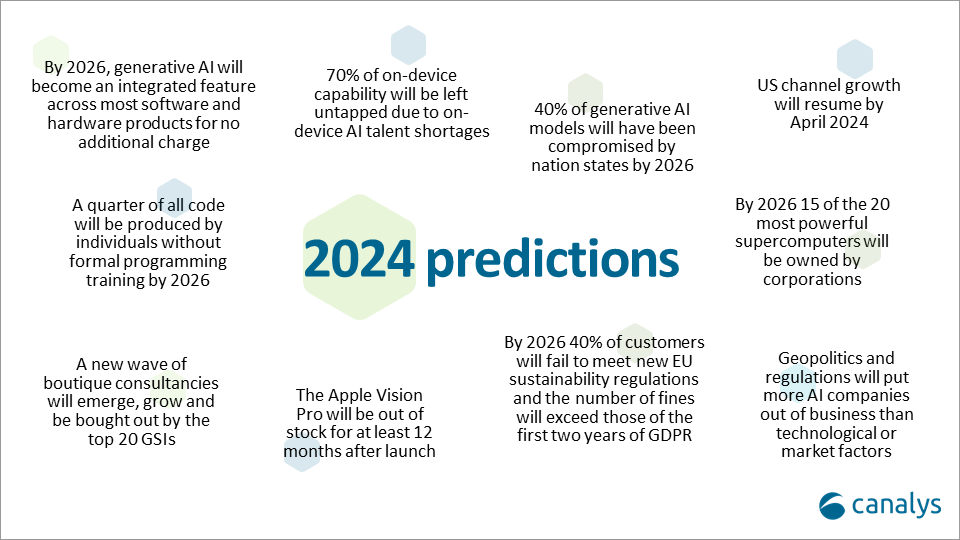

AI will take center stage, but its contribution will be amplified in future years

Gen AI will be the catalyst for a multi-year investment cycle across all IT segments. While 2024 is the starting point, AI will reshape the entire tech landscape in the coming years. AI for infrastructure (AIOps) and infrastructure for AI, AI embedded in software, applications, plug-ins and devices, and services that help companies plan, adopt, implement, use, and optimize AI will present new growth opportunities. Canalys forecasts gen AI will be a US$159 billion opportunity for the channel ecosystem by 2028. Formulating a clear strategy, building in-house expertise and developing strategic partnerships must be priorities for channel partners this year to capitalize on future AI growth opportunities.

Market trends to watch:

- The PC market will return to growth: Canalys forecasts a revival in PC sales, with AI-capable models adding a boost to the ongoing refresh cycle.

- Servers will offset a decline in networking in the infrastructure segment: investment in higher-priced and more powerful AI-capable servers will offset a decline in networking hardware spending.

- Cybersecurity will remain an investment priority: due to evolving threats, cybersecurity spending will remain robust, with XDR, SASE and CNAPP platform investment gaining traction.

- Demand for managed IT services will thrive: as complexity rises and organizations seek expertise, managed IT services growth will outpace total IT spending, with cybersecurity, application, and cloud infrastructure management being of priority.

- Commitments to cloud infrastructure services will rise: cloud infrastructure services growth will reaccelerate, fueled by larger spending commitments as customers plan for the next wave of cloud migration and AI adoption.

- AI will become a feature, not a fee: while software with integrated AI will boost near-term spending, expect it to become a standard feature in the long run.

Get in touch if you are interested in the details behind this latest Global IT Opportunity update.