Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The rise of open earbuds: challenges and opportunities

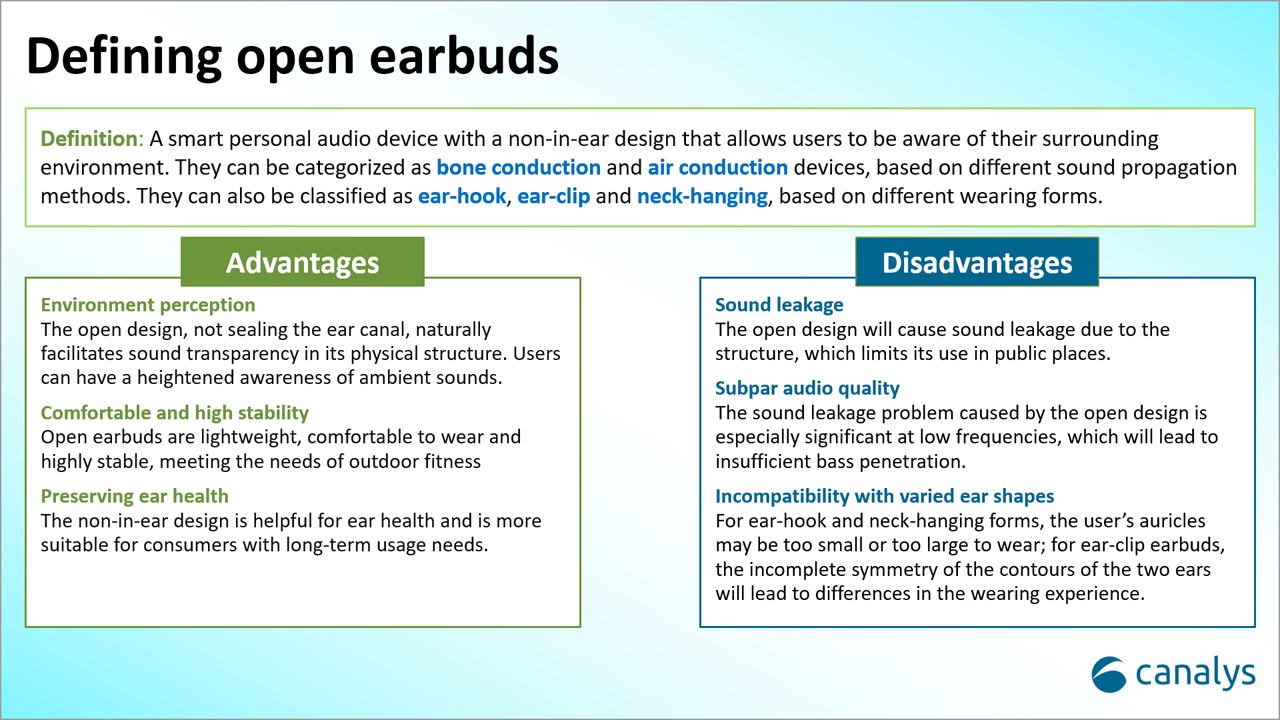

Open earbuds, sometimes loosely referred to as Open Wearable Stereo (OWS), have emerged to meet the growing demand for sports earbuds.

Against the backdrop of a global economic downturn, there are signs that demand for personal audio is falling. But the COVID-19 pandemic has led to a renewed focus on health and fitness, resulting in increased demand for sports and outdoor activities. Open earbuds, sometimes loosely referred to as Open Wearable Stereo (OWS), have emerged to meet the growing demand for sports earbuds. The design of open earbuds, which do not block the ear canal, addresses potential health concerns and opens up new growth opportunities for smart personal audio.

According to Canalys estimates, in Q4 2023, open-air earbuds accounted for 2.9% of the smart personal audio market, with 68.2% quarter-on-quarter growth. Though this is a relatively small market share, the rapid growth and ample room for expansion have attracted enthusiastic participation from various players, resulting in a dynamic market and numerous options. Thanks to its unique advantages and disadvantages, this category is gaining prominence in the personal audio market.

Different types of players

There are two categories of players based on how much open earbuds influence the vendors’ marketing strategies: emerging players, such as Oladance, Shokz and Cleer, and renowned brand players.

- Oladance has a strong development foundation and specializes in creating customized marketing strategies for specific user groups. The founding team of Oladance came from Bose, which provided a solid foundation for acoustic development. By focusing on specific user groups, particularly the highly loyal running community discovered during the initial crowdfunding phase, Oladance has increased customer loyalty and expanded brand awareness through various ecommerce channels.

- Shokz is a company that aims to move upstream in the supply chain by focusing on developing skin-friendly silicone and achieving the ultimate skin feel. The company initially used offline channels, such as BestBuy, Costco and specialist cycling stores, to acquire customers. Later, it expanded its reach by advertising on ecommerce platforms, such as Amazon, and expanding into international markets. This strategy helped Shokz achieve significant results.

- Cleer focuses on precisely matching application scenarios and smart features. Its open earbuds come in three versions – music, sports and gaming – to cater to the diverse needs of different user groups. Cleer has innovatively provided intelligent functions, such as a smart “anti-lost” feature and sedentary reminders, which sets it apart in the market.

To succeed in a competitive market, both technical excellence and effective marketing are crucial. Technical excellence involves continuous innovation, research and development, and providing exceptional customer experiences. Marketing requires tailored go-to-market and channel strategies to establish a brand image, increase brand awareness and expand into new markets.

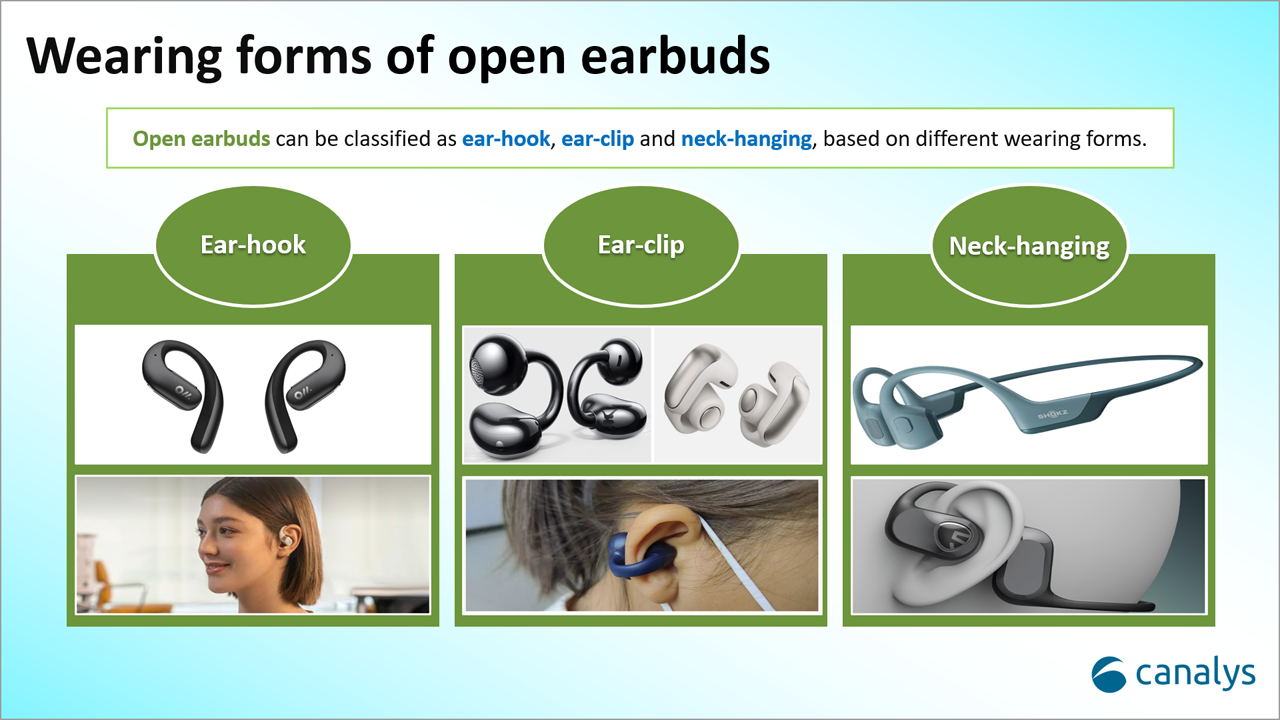

There are two types of renowned brand players in the market: audio vendors such as Sony, Bose and JBL, and smartphone brands such as Xiaomi and Huawei. These brands have taken different approaches to open earbuds. Sony, for instance, has been exploring consumer preferences with unique open earbud designs. On the other hand, Bose and JBL have opted for a more conservative approach by introducing ear-hook forms. While audio vendors are quick to respond to new form factors, they treat them as attempts in a new sub-segment and do not invest heavily in resources.

In the smartphone market, Xiaomi introduced its first bone-conduction earbuds in late October 2023, while Huawei launched its first clip-on open earbuds, FreeClip, in December. The FreeClip boasts an innovative design and uses Huawei’s ecosystem to provide lossless sound, attracting significant market attention. Meanwhile, other smartphone vendors have yet to release similar products, adopting a wait-and-see approach.

Opportunities and challenges

Despite opportunities, the open earbuds market faces challenges. Increased competition, especially from smartphone manufacturers leveraging their channel and ecosystem integration advantages, squeezes out other players. Additionally, market education remains a hurdle, with consumers needing better awareness. Mature products are costly, dissuading some from trying, while entry-level options, mainly from white-label players, lack maturity and may negatively affect market perception.

Vendors can address these challenges from two perspectives:

- Actively exploring diverse application scenarios: Open earbuds are currently primarily limited to sport-related use cases. Vendors can build on this foundation to explore other application scenarios, such as communication in office environments, to unearth more potential market demands.

- Strengthening market education: Intensifying market education through advertising, social media and other channels to convey the unique advantages of open earbuds. Building brand awareness and enhancing users’ understanding of these products is crucial.

The open earbuds market is growing rapidly, with emerging players and renowned brands alike competing to create innovative products and effective marketing strategies. Despite increased competition and challenges, vendors can capitalize on the growing demand for outdoor activities by focusing on technical innovation, customized marketing and diverse application scenarios.