Nine vendors have been crowned EMEA Champions in the Canalys EMEA Titans Channel Leadership Matrix

22 February 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

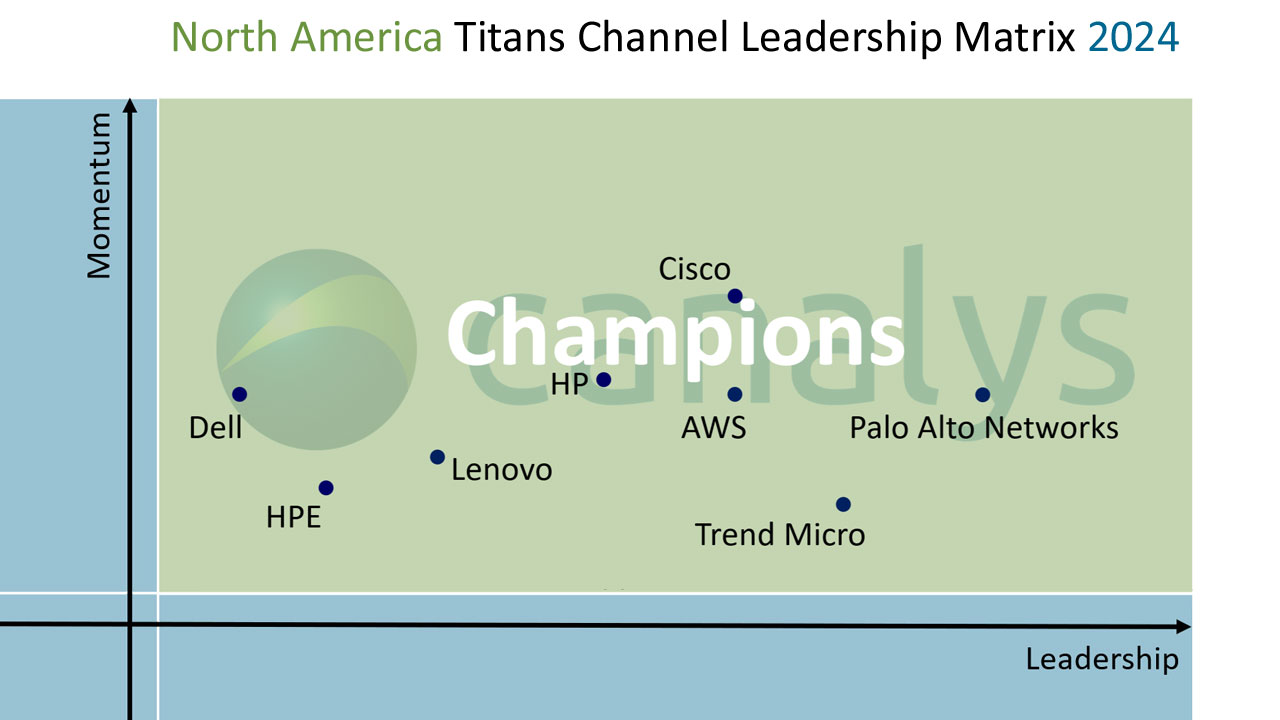

Eight vendors have achieved Champion status in the inaugural 2024 Canalys North American Titans Channel Leadership Matrix: AWS, Cisco, Dell, HP, HPE, Lenovo, Palo Alto Networks and Trend Micro.

Eight vendors have achieved Champion status in the inaugural 2024 Canalys North American (NA) Titans Channel Leadership Matrix: AWS, Cisco, Dell, HP, HPE, Lenovo, Palo Alto Networks and Trend Micro.

Canalys has published its first NA Titans Channel Leadership Matrix 2024, adding to its series of Leadership Matrix reports. This matrix’s objective is to assess which vendors are playing an integral role in driving the success of the North American partner ecosystem across their respective channel and technology areas.

2023 presented a complex landscape for the North American IT channel, with growth rates varying significantly across different technology sectors. As in 2022, most hardware vendors and partners struggled to achieve growth, mainly due to the difficulties of access to capital, primarily stemming from high interest and inflation rates – which led to most customers opting to shrink their IT budgets and prolong the usable life of their PCs, servers and storage devices. The one exception was networking, where easing in supply chains and a return to offices led to a return to growth for the category, and partners were able to capitalize on this. Furthermore, cybersecurity and cloud have thrived as cyber-attacks continued to escalate and public cloud adoption became increasingly necessary for business. More partners continued to see their cloud practices maturing; many made acquisitions to bolster their capabilities in both cloud and cybersecurity.

Vendors rated as Champions showed the highest levels of excellence in channel management compared with their industry peers throughout 2023. These thought and innovation leaders in the channel also demonstrated some consistent characteristics, including positive partner sentiment, a commitment to improving ease of doing business, a willingness to boost growth opportunities and increase profitability for partners, and a commitment to growing the share of revenue generated through and with the channel. The various successful channel initiatives that Champions rolled out included:

Looking ahead to 2024, many of the recent challenges affecting the IT channel are expected to subside as supply volatility, inflation and rising interest rates continue to ease. As market conditions become increasingly stable, competition will intensify. Therefore, the need for differentiation beyond price will become more pertinent. For technology vendors, it is critical to identify the opportunities that will provide growth opportunities for their partner ecosystems and continue to invest in enablement and programs to help capture those opportunities. For example, vendors should invest more in training programs for partners in AI and hybrid cloud as more customers look to adopt the capabilities into their processes.

The NA Titans Channel Leadership Matrix considers the channel performance of vendors that operate in North America with at least US$12 billion in global sales (over 25% delivered through partners) or between US$2 billion and US$12 billion in global sales (over 50% delivered through partners). Among a pool of 135 vendors in North America, 26 met the minimum qualifications for placement.

A vendor’s position in the NA Titans Channel Leadership Matrix is based on three primary inputs: partner ecosystem feedback, performance metrics and Canalys analysts’ assessments.

Besides the eight Champions highlighted, other vendors were classified as Contenders (high leadership ratings in the areas assessed but either yet to capitalize fully on channel opportunities or have been outpaced by competitors or peers), Scalers (improvements in channel management and performance but yet to achieve the highest levels of consistency in channel excellence) or Foundation vendors, which have the lowest ratings and have also suffered a deterioration in partner sentiment over the last 12 months.

Congratulations to AWS, Cisco, Dell, HP, HPE, Lenovo, Palo Alto Networks and Trend Micro for achieving Champion status in the inaugural North American Titans Channel Leadership Matrix.