IT security spend to reach $30.1 billion in 2017

Shanghai, Palo Alto, Singapore and Reading – Monday, 12 August 2013

Canalys has released its latest set of country-level worldwide IT security forecasts. Security remains a priority for businesses and though they may be slashing their IT budgets due to tough economic conditions, investment in security solutions is less affected than other infrastructure areas, such as networking and unified communications. Through to 2017 Canalys expects the worldwide IT security market to grow at a compound annual rate of 6.6%, to reach $30.1 billion in 2017.

From a regional standpoint, Asia Pacific is forecast to increase 9% in 2013 as budgets continue to grow in the large economies of China, India and Japan as well as other countries across the region. The largest and most mature market, North America, is projected to grow at a stable rate of 5% over the next five years. Latin America, on the other hand, continues to be a high-growth market and IT security spend is expected to increase by 15% in 2013, driven by large infrastructure projects. EMEA was the slowest-growing market in 2012, up just 3%. ‘The sluggish growth was primarily down to the poor performance of the European market, which was hindered by economic uncertainty,’ said Canalys Analyst Nushin Vaiani. ‘We expect an increase in investment as businesses of all sizes begin to gear up for the impending changes to the EU data protection directive. This will work to boost overall growth in the EMEA market to 8% for full-year 2013.’

Canalys estimates that medium-sized businesses will be the biggest growth segment over the next five years, growing by a compound annual rate of 7.3% to reach $8.5 billion in 2017. ‘Medium-sized businesses are prioritizing more of their IT budgets and resources to ensure their businesses are compliant with various data protection regulations. They also want to give their customers reassurance about the services they provide.’

These businesses are expected to invest heavily in all market segments, with network security leading the way, driven by the need for solutions with advanced capabilities in application control as well as greater scalability. Content security spend will be dominated by encryption and data-loss prevention (DLP) solutions due to the growing need to protect corporate data. Security management investment is growing in importance among medium-sized businesses due to the need to have greater visibility across an increasingly varied infrastructure. The growing bring-your-own-technology trend and the shift to virtual and cloud environments represent major developments that are forcing businesses to rethink their security posture and fuelling product refresh cycles. ‘Corporate data in today’s world resides in a fragmented ecosystem of on-premises, virtual and cloud environments. This shift will continue to drive security and infrastructure management investment over the next few years,’ added Vaiani.

Medium-sized businesses are defined as those with between 100 and 499 employees.

Content security includes anti-malware, data-loss prevention (DLP), encryption, messaging security and web threat security products.

Network security includes firewall/virtual private network (FW/VPN), intrusion prevention system (IPS), integrated threat management (ITM), network access control (NAC) and secure socket layer virtual private network (SSL VPN) products.

Security management includes identity and access management (IAM) and security information and event management (SIEM) products.

Canalys is an independent analyst firm that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. Our customer-driven analysis and consulting services empower businesses to make informed decisions and generate sales. We stake our reputation on the quality of our data, our innovative use of technology, and our high level of customer service.

To receive press releases directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

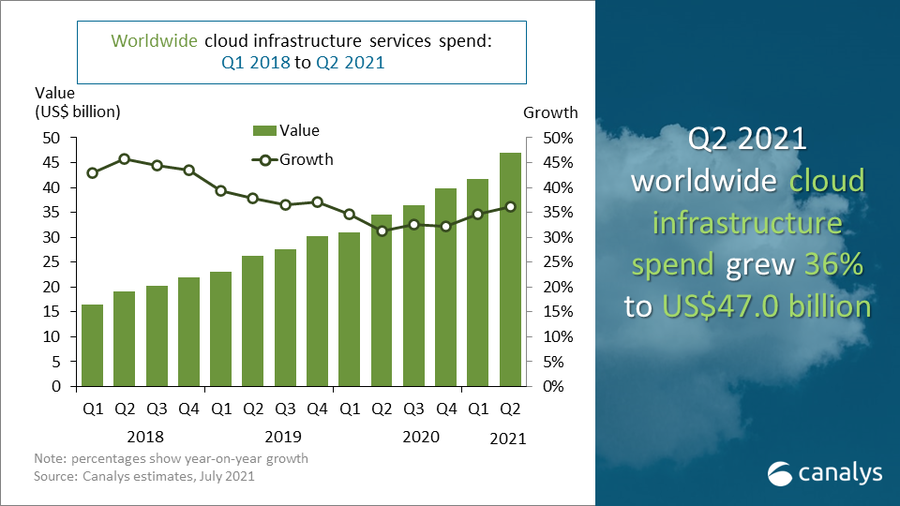

Global cloud services spending exceeded US$47 billion in Q2 2021